Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

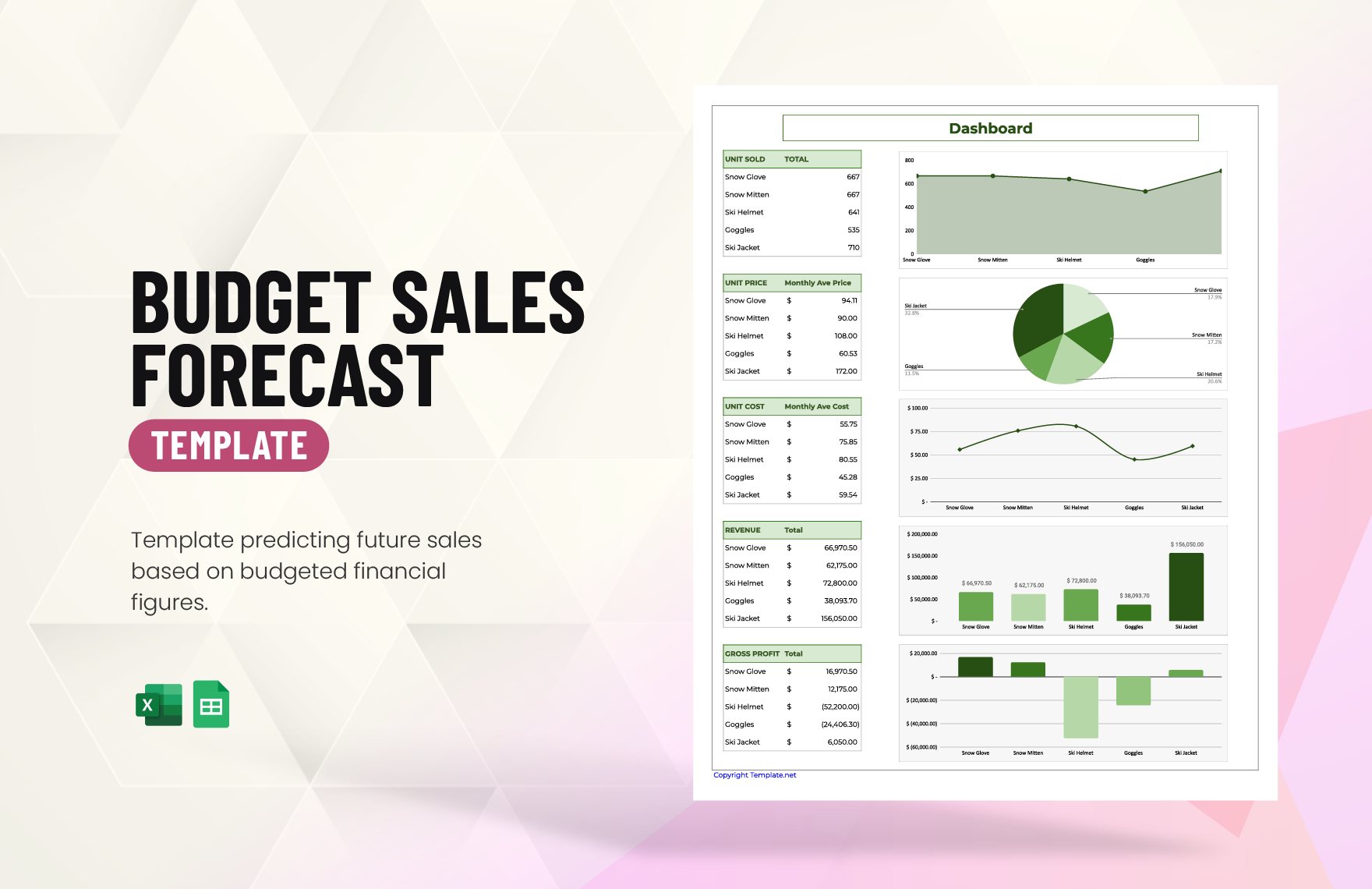

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

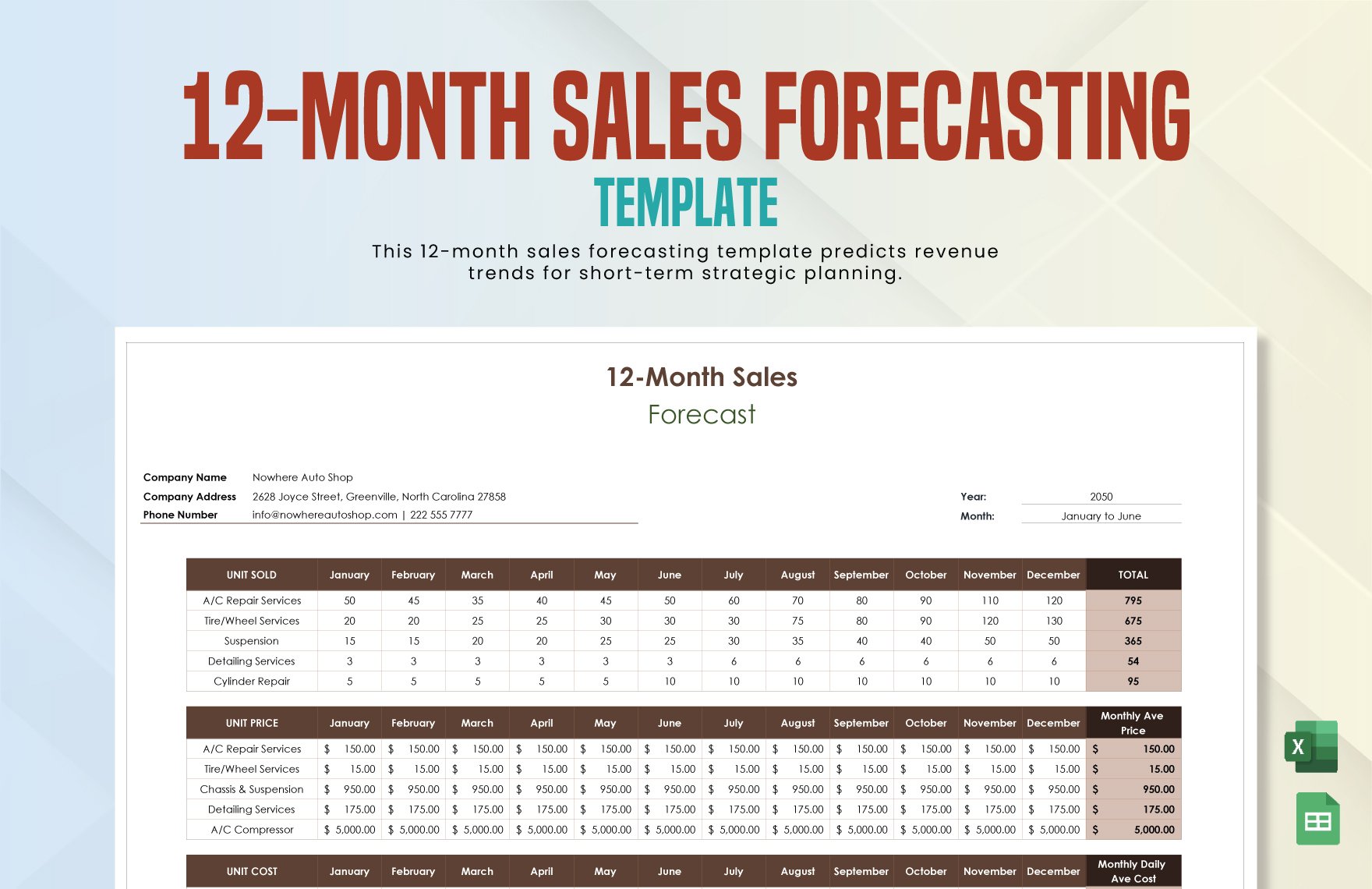

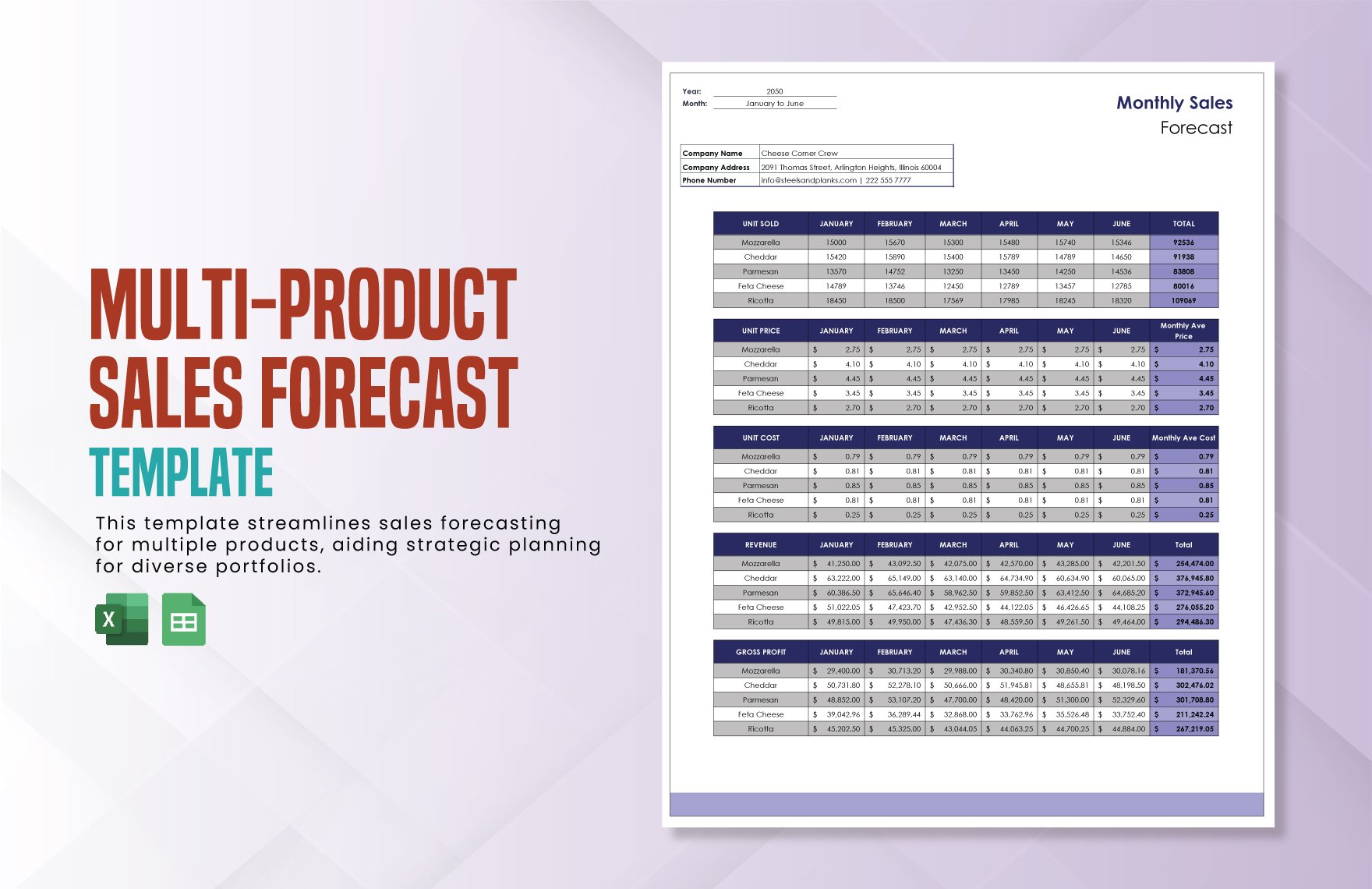

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

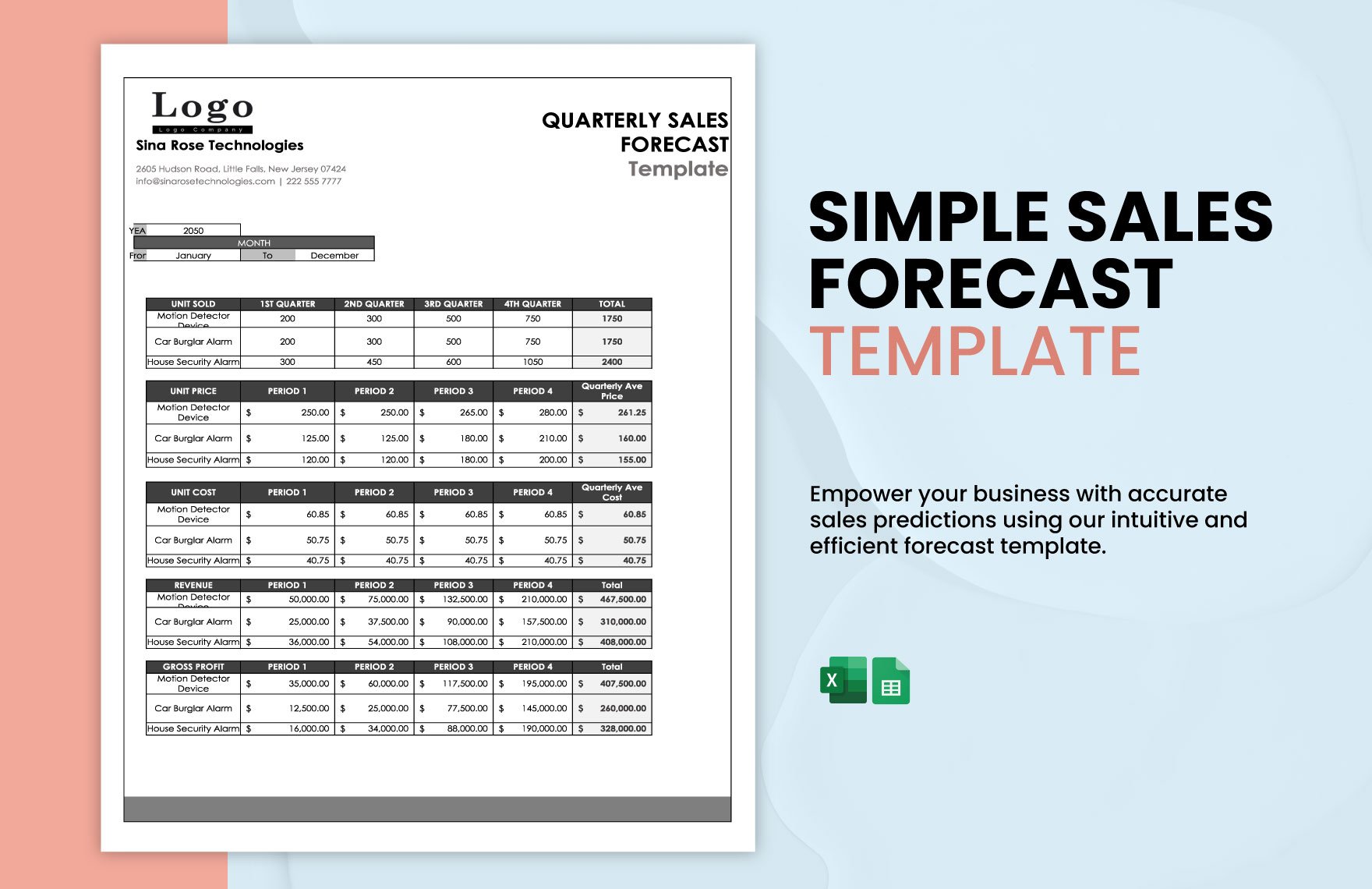

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Free Business Plan Excel Template [Excel Download]

Written by Dave Lavinsky

A business plan is a roadmap for growing your business. Not only does it help you plan out your venture, but it is required by funding sources like banks, venture capitalists and angel investors.

Download our Ultimate Business Plan Template here >

The body of your business plan describes your company and your strategies for growing it. The financial portion of your plan details the financial implications of your business: how much money you need, what you project your future sales and earnings to be, etc.

Below you will be able to download our free business plan excel template to help with the financial portion of your business plan. You will also learn about the importance of the financial model in your business plan.

Download the template here: Financial Plan Excel Template

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less! It includes a simple, plug-and-play financial model and a fill-in-the-blanks template for completing the body of your plan.

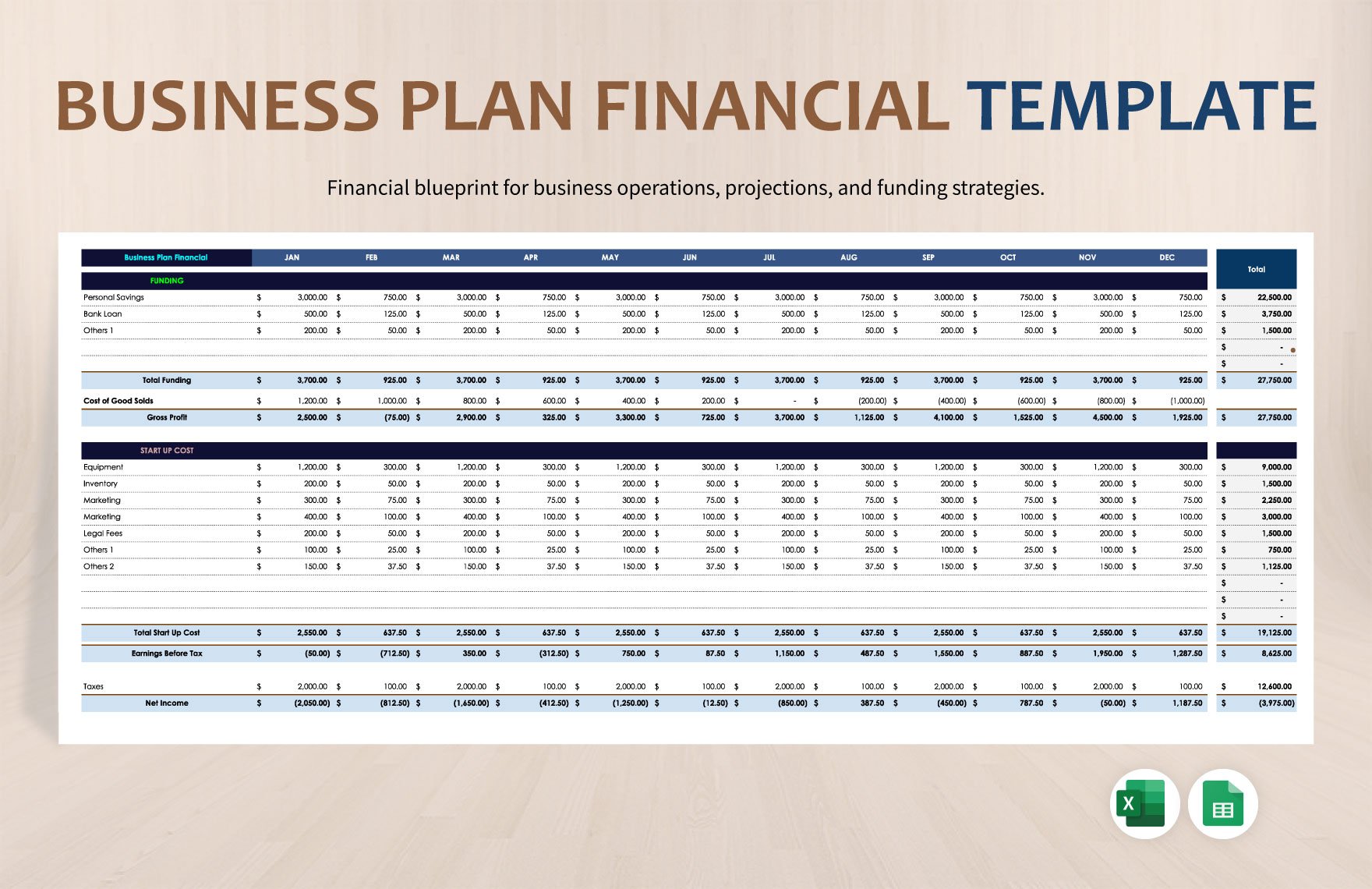

What’s Included in our Business Plan Excel Template

Our business plan excel template includes the following sections:

Income Statement : A projection of your business’ revenues, costs, and expenses over a specific period of time. Includes sections for sales revenue, cost of goods sold (COGS), operating expenses, and net profit or loss.

Example 5 Year Annual Income Statement

Cash Flow Statement : A projection of your business’ cash inflows and outflows over a specific period of time. Includes sections for cash inflows (such as sales receipts, loans, and investments), cash outflows (such as expenses, salaries, and loan repayments), and net cash flow.

Example 5 Year Annual Cash Flow Statement

Balance Sheet : A snapshot of your business’ financial position at a specific point in time. Includes sections for assets (such as cash, inventory, equipment, and property), liabilities (such as loans, accounts payable, and salaries payable), and owner’s equity (such as retained earnings and capital contributions).

Example 5 Year Annual Balance Sheet

Download the template here: Business Plan Excel Template

The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business. Remember to review and update your financial plan regularly to track your progress and make informed financial decisions.

Finish Your Business Plan Today!

The importance of the financial model in your business plan.

A solid financial model is a critical component of any well-prepared business plan. It provides a comprehensive and detailed projection of your business’ financial performance, including revenue, expenses, cash flow, and profitability. The financial model is not just a mere set of numbers, but a strategic tool that helps you understand the financial health of your business, make informed decisions, and communicate your business’ financial viability to potential investors, lenders, and other stakeholders. In this article, we will delve into the importance of the financial model in your business plan.

- Provides a roadmap for financial success : A well-structured financial model serves as a roadmap for your business’ financial success. It outlines your revenue streams, cost structure, and cash flow projections, helping you understand the financial implications of your business strategies and decisions. It allows you to forecast your future financial performance, set financial goals, and measure your progress over time. A comprehensive financial model helps you identify potential risks, opportunities, and areas that may require adjustments to achieve your financial objectives.

- Demonstrates financial viability to stakeholders : Investors, lenders, and other stakeholders want to see that your business is financially viable and has a plan to generate revenue, manage expenses, and generate profits. A robust financial model in your business plan demonstrates that you have a solid understanding of your business’ financials and have a plan to achieve profitability. It provides evidence of the market opportunity, pricing strategy, sales projections, and financial sustainability. A well-prepared financial model increases your credibility and instills confidence in your business among potential investors and lenders.

- Helps with financial decision-making : Your financial model is a valuable tool for making informed financial decisions. It helps you analyze different scenarios, evaluate the financial impact of your decisions, and choose the best course of action for your business. For example, you can use your financial model to assess the feasibility of a new product launch, determine the optimal pricing strategy, or evaluate the impact of changing market conditions on your cash flow. A well-structured financial model helps you make data-driven decisions that are aligned with your business goals and financial objectives.

- Assists in securing funding : If you are seeking funding from investors or lenders, a robust financial model is essential. It provides a clear picture of your business’ financials and shows how the funds will be used to generate revenue and profits. It includes projections for revenue, expenses, cash flow, and profitability, along with a breakdown of assumptions and methodology used. It also provides a realistic assessment of the risks and challenges associated with your business and outlines the strategies to mitigate them. A well-prepared financial model in your business plan can significantly increase your chances of securing funding as it demonstrates your business’ financial viability and growth potential.

- Facilitates financial management and monitoring : A financial model is not just for external stakeholders; it is also a valuable tool for internal financial management and monitoring. It helps you track your actual financial performance against your projections, identify any deviations, and take corrective actions if needed. It provides a clear overview of your business’ cash flow, profitability, and financial health, allowing you to proactively manage your finances and make informed decisions to achieve your financial goals. A well-structured financial model helps you stay on top of your business’ financials and enables you to take timely actions to ensure your business’ financial success.

- Enhances business valuation : If you are planning to sell your business or seek investors for an exit strategy, a robust financial model is crucial. It provides a solid foundation for business valuation as it outlines your historical financial performance, future projections, and the assumptions behind them. It helps potential buyers or investors understand the financial potential of your business and assess its value. A well-prepared financial model can significantly impact the valuation of your business, and a higher valuation can lead to better negotiation terms and higher returns on your investment.

- Supports strategic planning : Your financial model is an integral part of your strategic planning process. It helps you align your financial goals with your overall business strategy and provides insights into the financial feasibility of your strategic initiatives. For example, if you are planning to expand your business, enter new markets, or invest in new technologies, your financial model can help you assess the financial impact of these initiatives, including the investment required, the expected return on investment, and the timeline for achieving profitability. It enables you to make informed decisions about the strategic direction of your business and ensures that your financial goals are aligned with your overall business objectives.

- Enhances accountability and transparency : A robust financial model promotes accountability and transparency in your business. It provides a clear framework for setting financial targets, measuring performance, and holding yourself and your team accountable for achieving financial results. It helps you monitor your progress towards your financial goals and enables you to take corrective actions if needed. A well-structured financial model also enhances transparency by providing a clear overview of your business’ financials, assumptions, and methodologies used in your projections. It ensures that all stakeholders, including investors, lenders, employees, and partners, have a clear understanding of your business’ financial performance and prospects.

In conclusion, a well-prepared financial model is a crucial component of your business plan. It provides a roadmap for financial success, demonstrates financial viability to stakeholders, helps with financial decision-making, assists in securing funding, facilitates financial management and monitoring, enhances business valuation, supports strategic planning, and enhances accountability and transparency in your business. It is not just a set of numbers, but a strategic tool that helps you understand, analyze, and optimize your business’ financial performance. Investing time and effort in creating a comprehensive and robust financial model in your business plan is vital for the success of your business and can significantly increase your chances of achieving your financial goals.

Confirm opening of the external link

Access our collection of user-friendly templates for business planning, finance, sales, marketing, and management, designed to assist you in developing strategies for either launching a new business venture or expanding an existing one.

You can use the templates below as a starting point to create your startup business plan or map out how you will expand your existing business. Then meet with a SCORE mentor to get expert business planning advice and feedback on your business plan.

If writing a full business plan seems overwhelming, start with a one-page Business Model Canvas. Developed by Founder and CEO of Strategyzer, Alexander Osterwalder, it can be used to easily document your business concept.

Download this template to fill out the nine squares focusing on the different building blocks of any business:

- Value Proposition

- Customer Segments

- Customer Relationships

- Key Activities

- Key Resources

- Key Partners

- Cost Structure

- Revenue Streams

For help completing the Business Model Canvas Template, contact a SCORE business mentor for guidance by phone

From creating a startup budget to managing cash flow for a growing business, keeping tabs on your business’s finances is essential to success. The templates below will help you monitor and manage your business’s financial situation, create financial projections and seek financing to start or grow your business.

This interactive calculator allows you to provide inputs and see a full estimated repayment schedule to plan your capital needs and cash flow.

A 12-month profit and loss projection, also known as an income statement or statement of earnings, provides a detailed overview of your financial performance over a one-year period. This projection helps you anticipate future financial outcomes by estimating monthly income and expenses, which facilitates informed decision-making and strategic planning.

If you’re trying to get a loan from a bank, they may ask you for a personal financial statement. You can use this free, downloadable template to document your assets, liabilities and net worth.

A Personal Financial Statement is a snapshot of

Marketing helps your business build brand awareness, attract customers and create customer loyalty. Use these templates to forecast sales, develop your marketing strategy and map out your marketing budget and plan.

How healthy is your business? Are you missing out on potential growth opportunities or ignoring areas of weakness? Do you need to hire employees to reach your goals? The following templates will help you assess the state of your business and accomplish important management tasks.

Whether you are starting your business or established and looking to grow, our Business Healthcheck Tool will provide practical information and guidance.

Learn how having a SCORE mentor can be a valuable asset for your business. A SCORE mentor can provide guidance and support in various areas of business, including finance, marketing, and strategy. They can help you navigate challenges and make important decisions based on their expertise and experience. By seeking out a SCORE mentor, you can gain the guidance and support you need to help grow your business and achieve success.

SCORE offers free business mentoring to anyone that wants to start, currently owns, or is planning to close or sell a small business. To initiate the process, input your zip code in the designated area below. Then, complete the mentoring request form on the following page, including as much information as possible about your business. This information is used to match you with a mentor in your area. After submitting the request, you will receive an email from your mentor to arrange your first mentoring session.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Financial Plan for a Business Plan

Noah Parsons

4 min. read

Updated July 11, 2024

Creating a financial plan for a business plan is often the most intimidating part for small business owners.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan in business plans

A sound financial plan for a business plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, you’ll need to include a few additional pieces of information as part of your business plan’s financial plan example.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your financial plan for a business plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan’s financial plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

How to Set and Use Milestones in Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

How to Write the Company Overview for a Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

FREE Business Plan Financial Templates

Whether It's a Startup Agency, Bakery, or Restaurant, Planning Your Business' Financials is Important. Get It Done Right with Our Free Business Plan Financial Templates. You Can Outline the Budget of Your Business and Design the Layout for the Breakdown and Balance Sheets. When It Comes to Financials, Template.net is the Answer. Download Now!

- Business Plan Financial Template in Word

Business Plan PowerPoint Presentation Template

Orthodox Christmas Wishes Vector Template

Business Plan Checklist

Simple Sales Forecast Template

E-commerce Sales Forecast Template

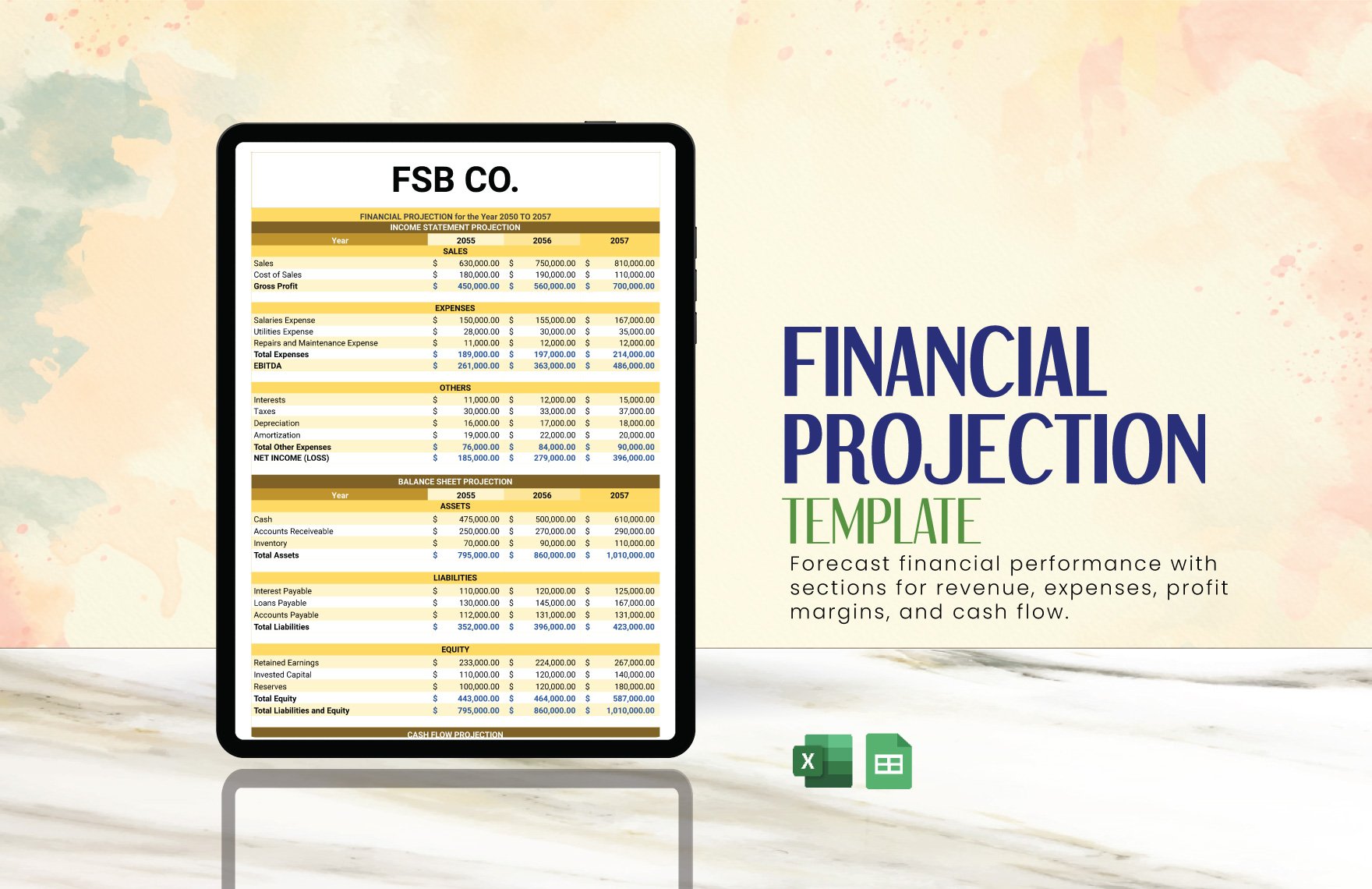

Financial Projection Template

Business Plan Spreadsheet

Orthodox Christmas Wishes Vector

Budget Sales Forecast Template

Financial Plan for Startup Business Template

Business Handbook Template

Small Business Plan Financial Template

Financial Plan for Startup Business Example Template

Financial Projections Small Business Plan Template

School Financial Reporting Policy Template

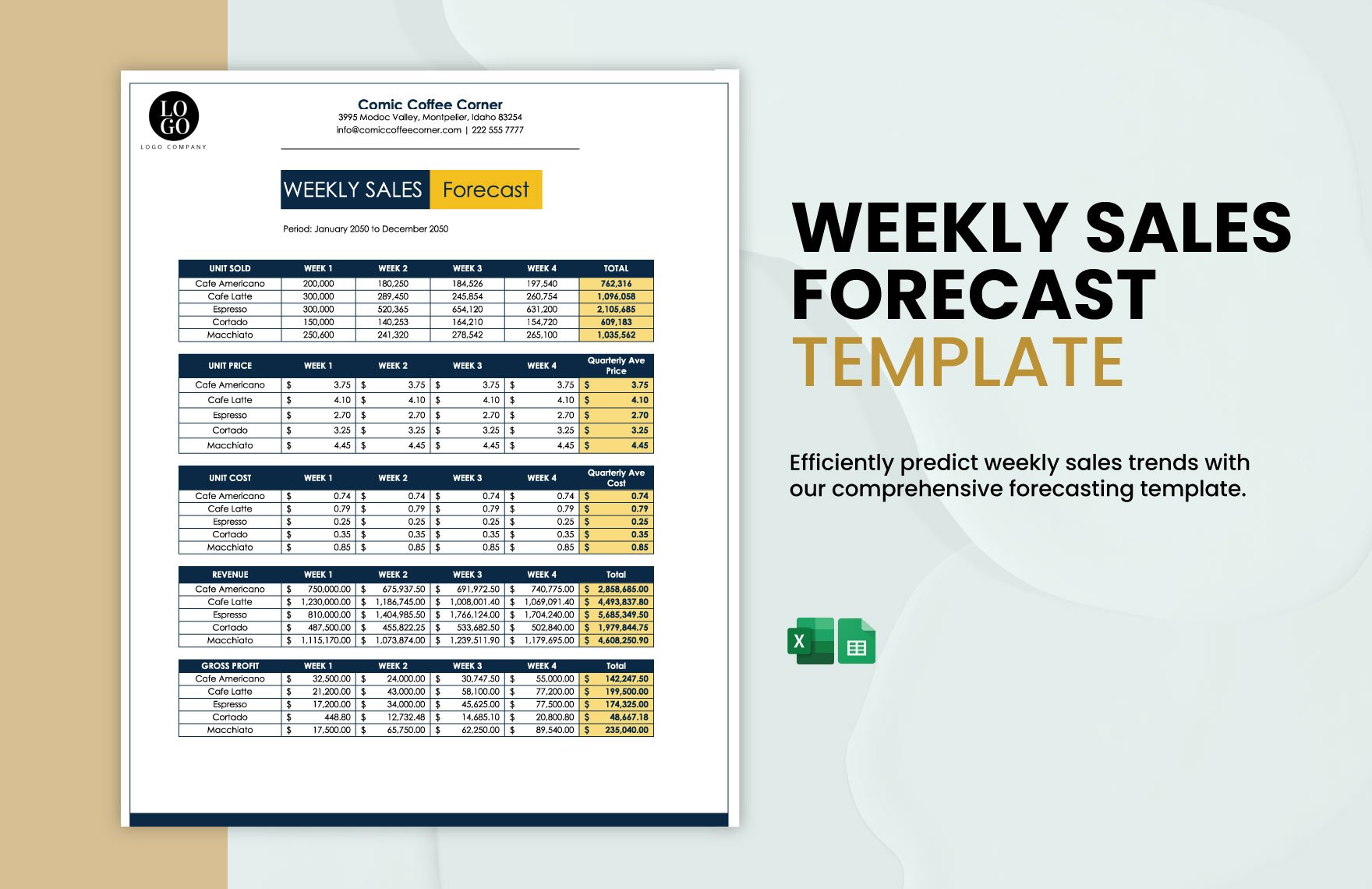

Weekly Sales Forecast Template

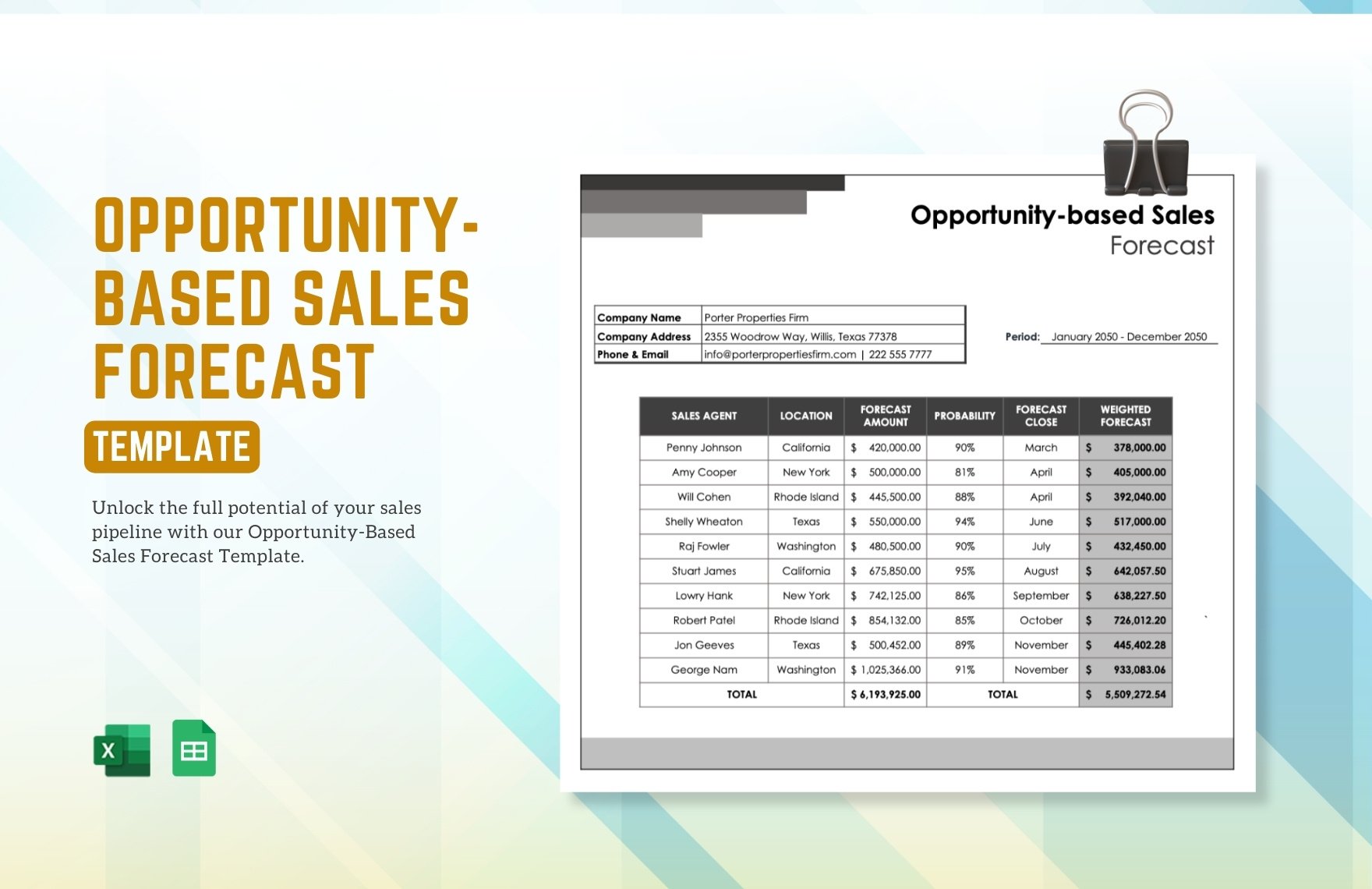

Opportunity-based Sales Forecast Template

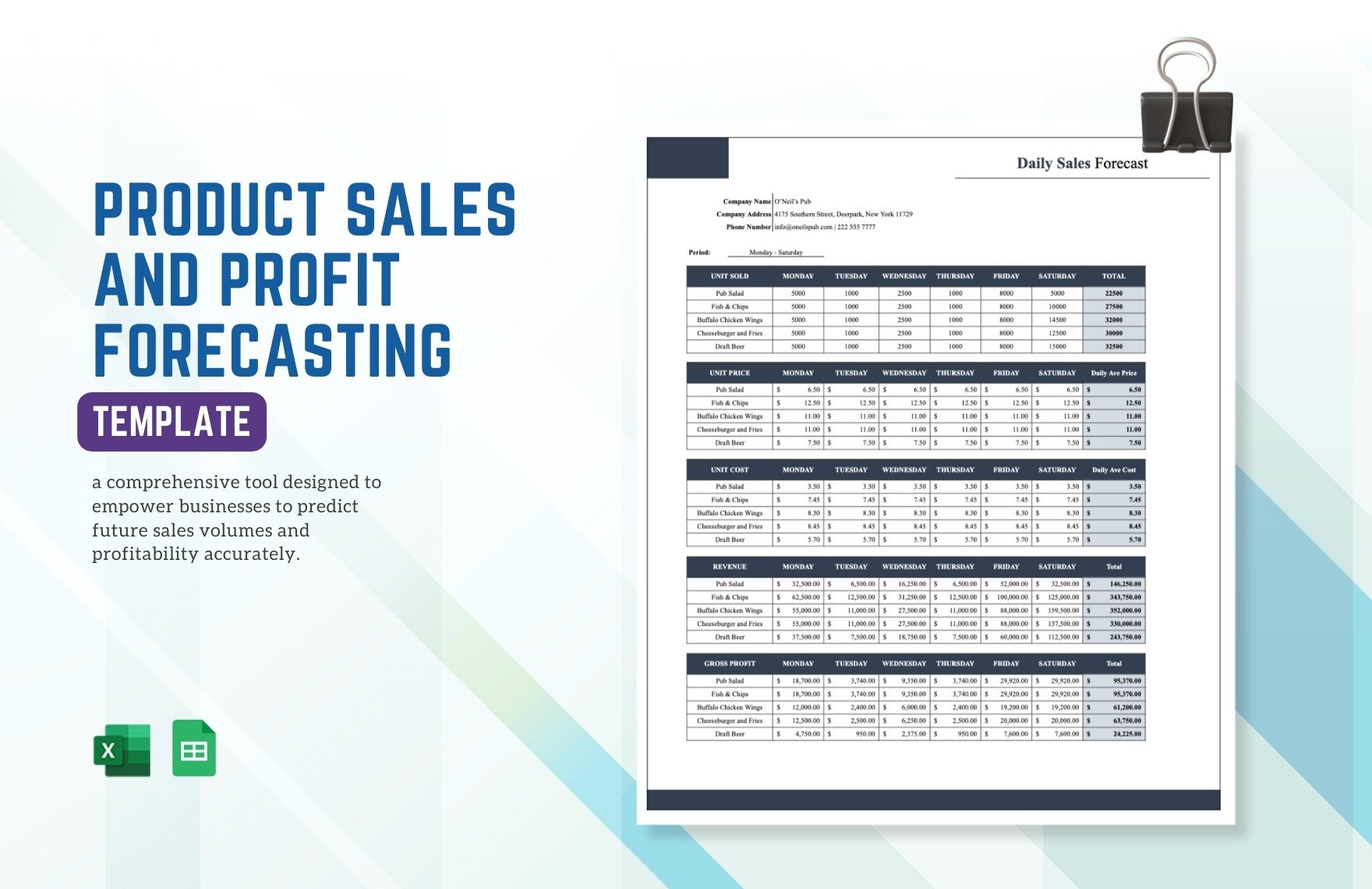

Product Sales And Profit Forecasting Template

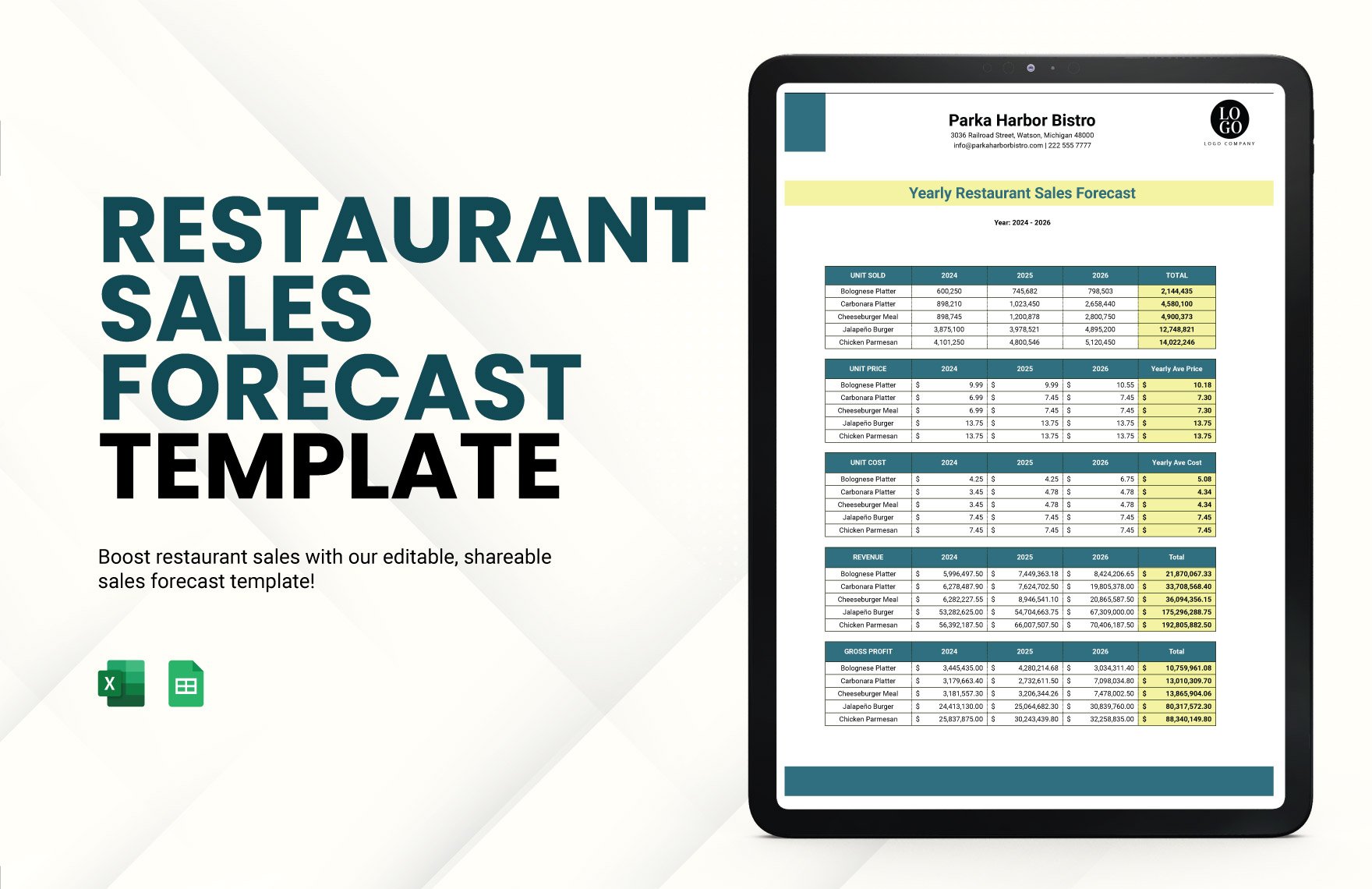

Restaurant Sales Forecast Template

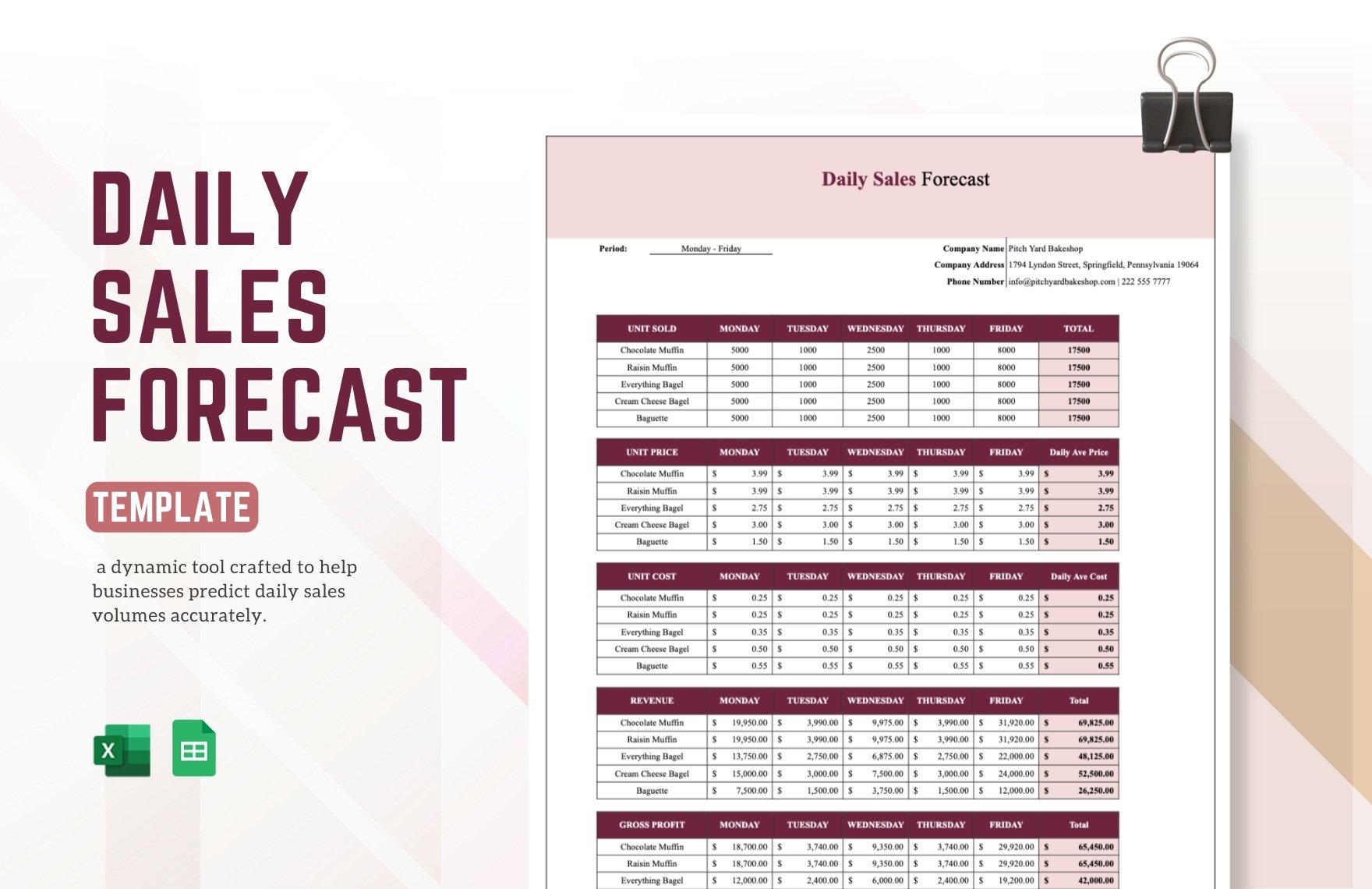

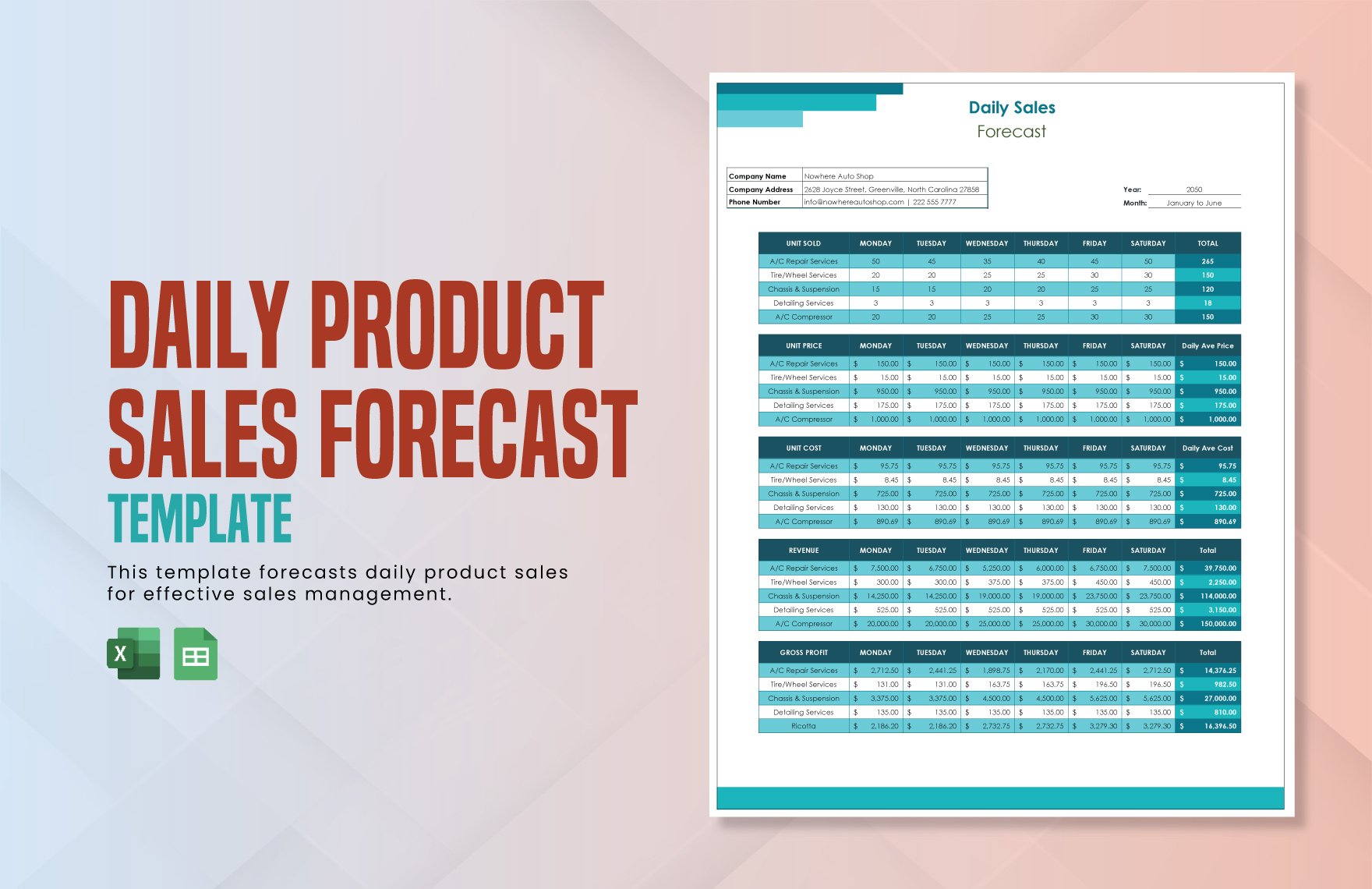

Daily Sales Forecast Template

3-year Sales Forecast Template

5-year Sales Forecast Template

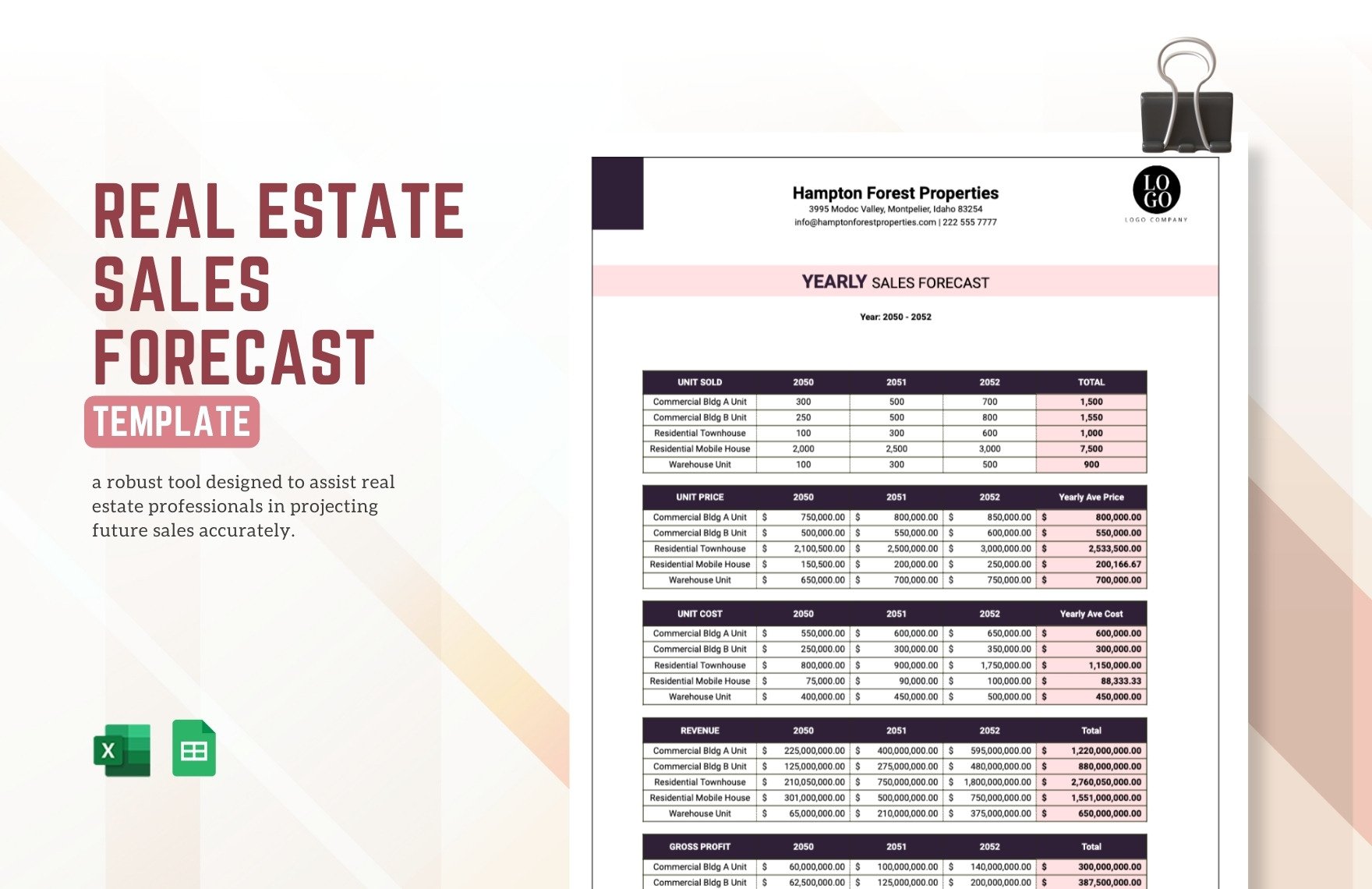

Real Estate Sales Forecast Template

12-month Sales Forecasting Template

Daily Product Sales Forecast Template

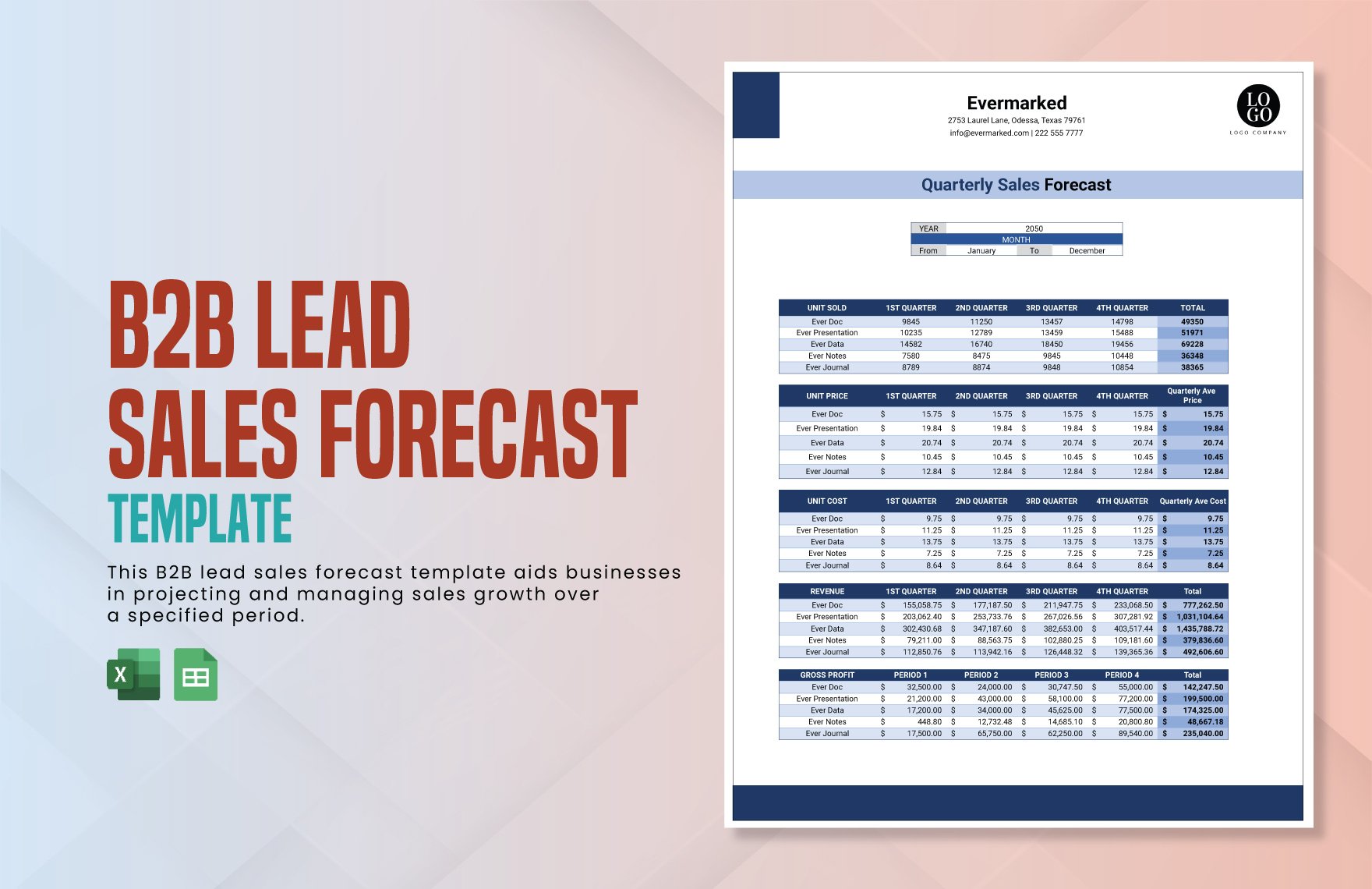

B2b Lead Sales Forecast Template

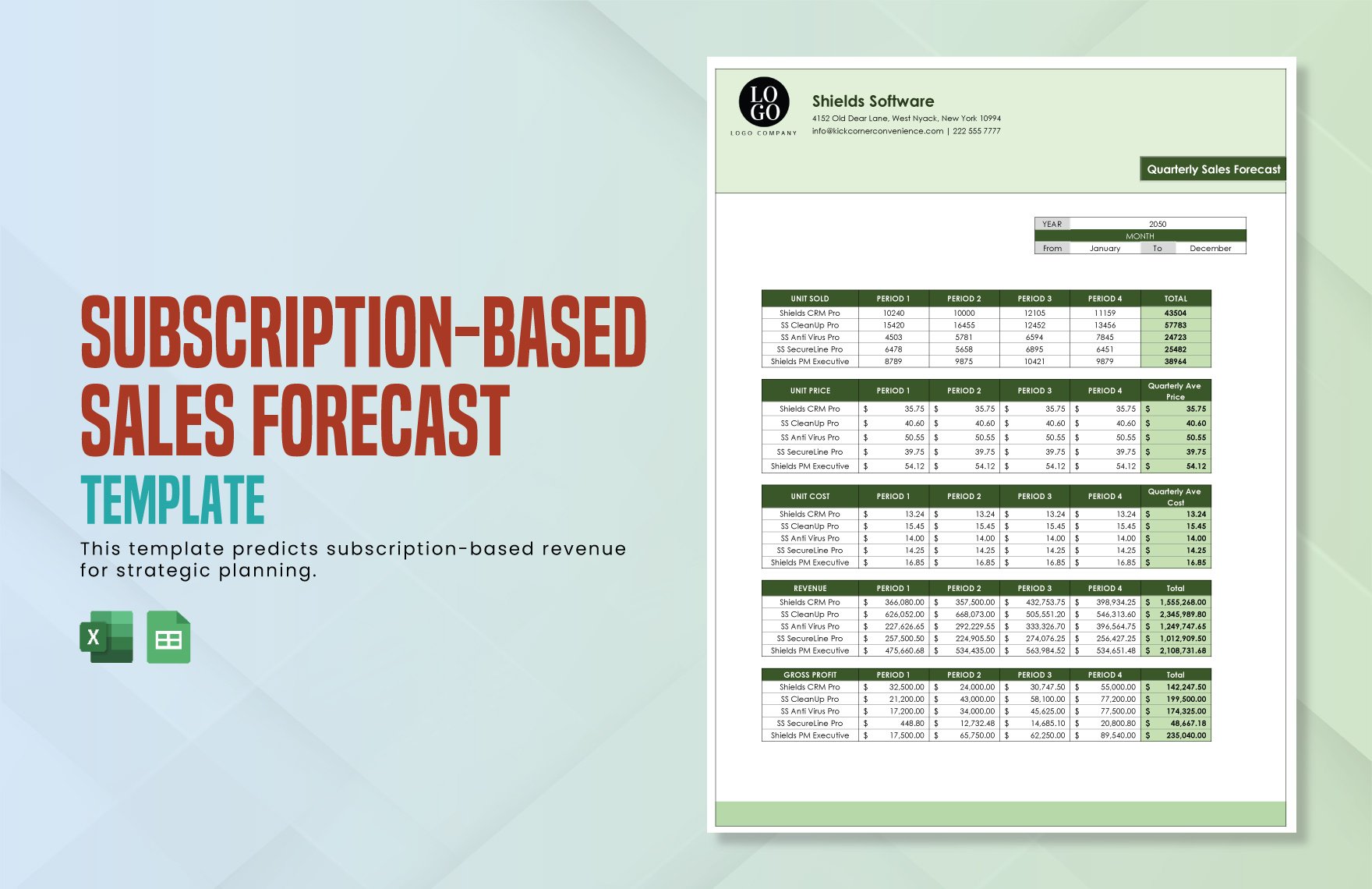

Subscription-based Sales Forecast Template

Multi-product Sales Forecast Template

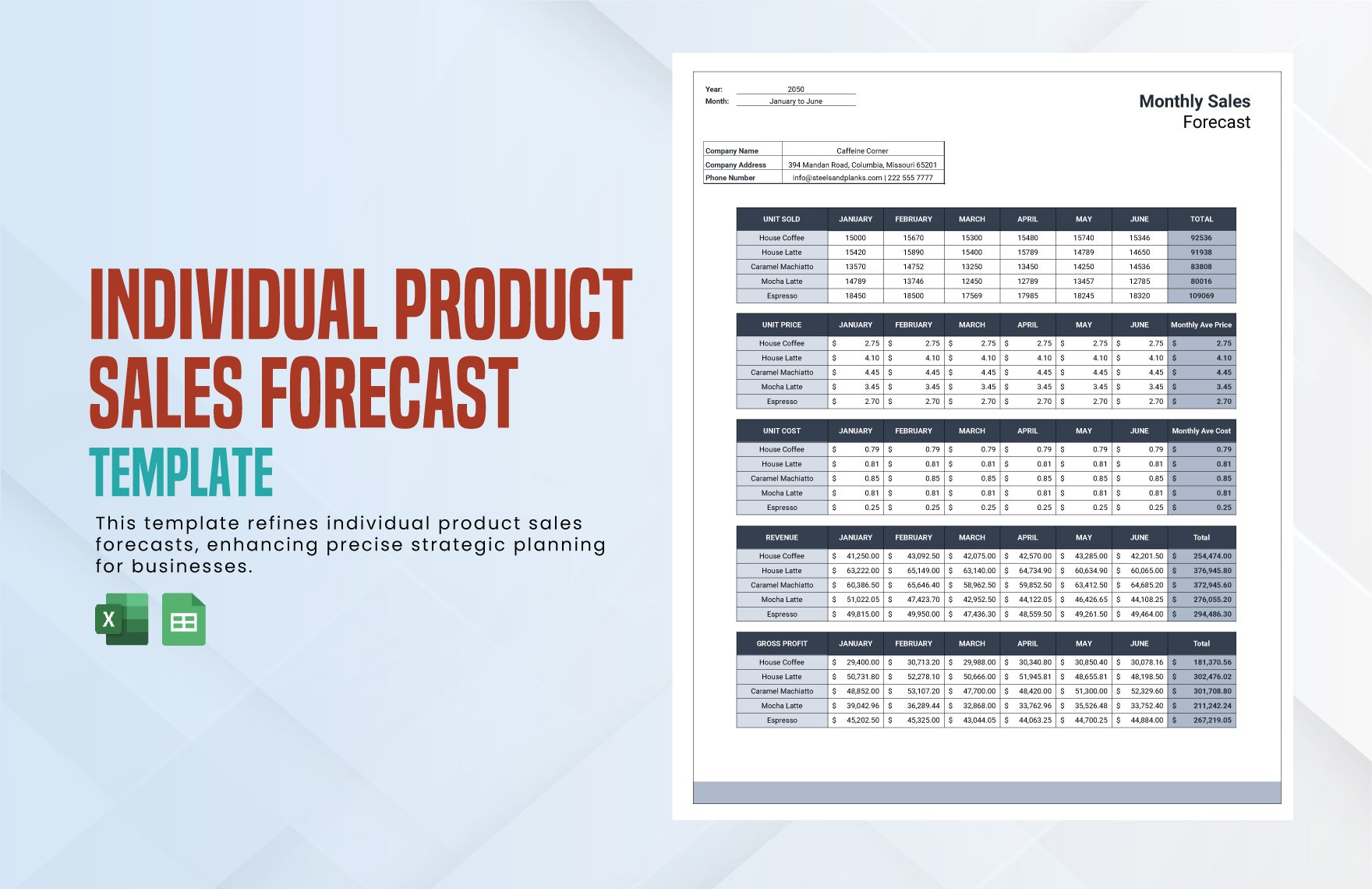

Individual Product Sales Forecast Template

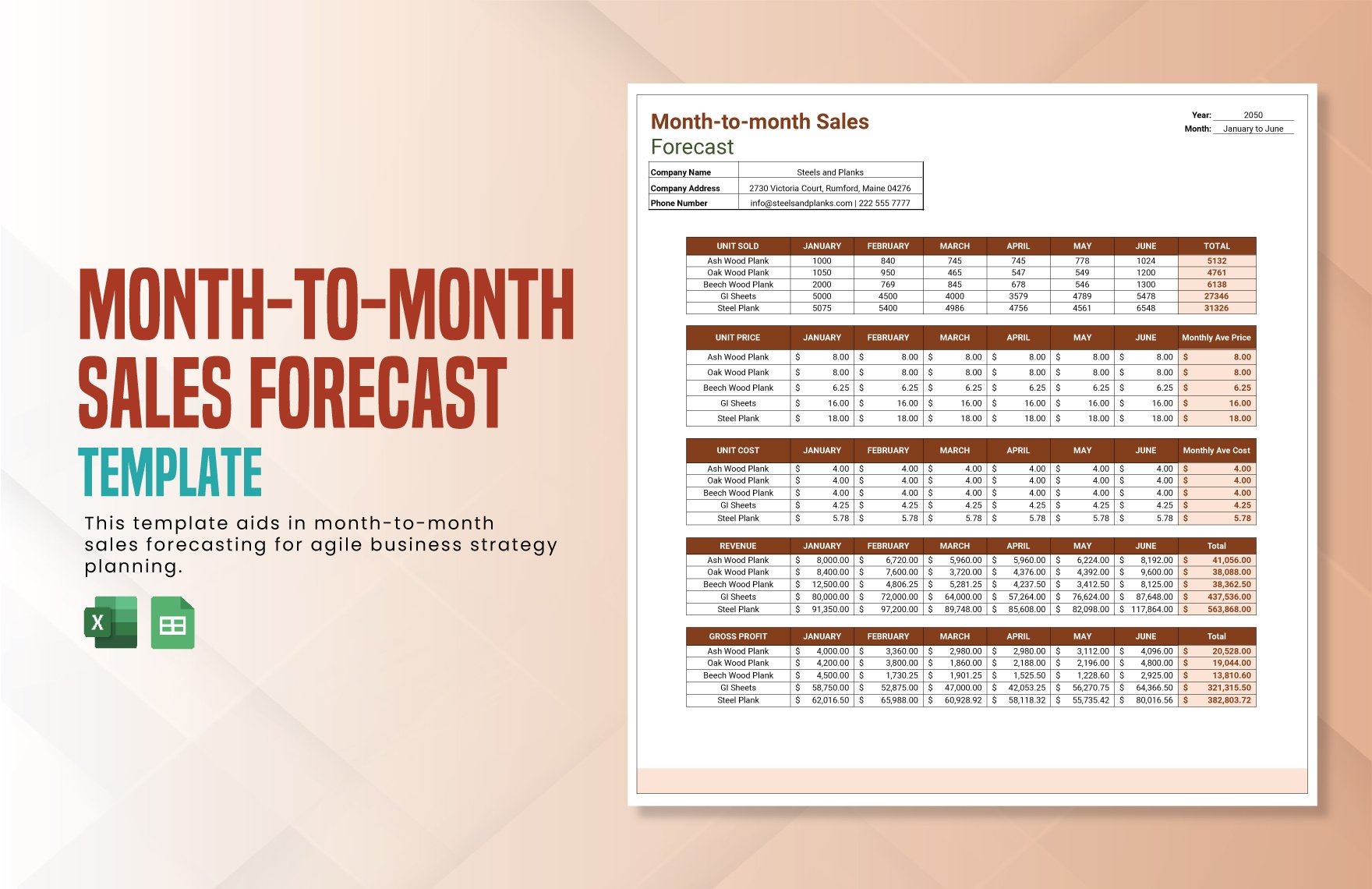

Month-to-month Sales Forecast Template

Retail Sales Forecast Template

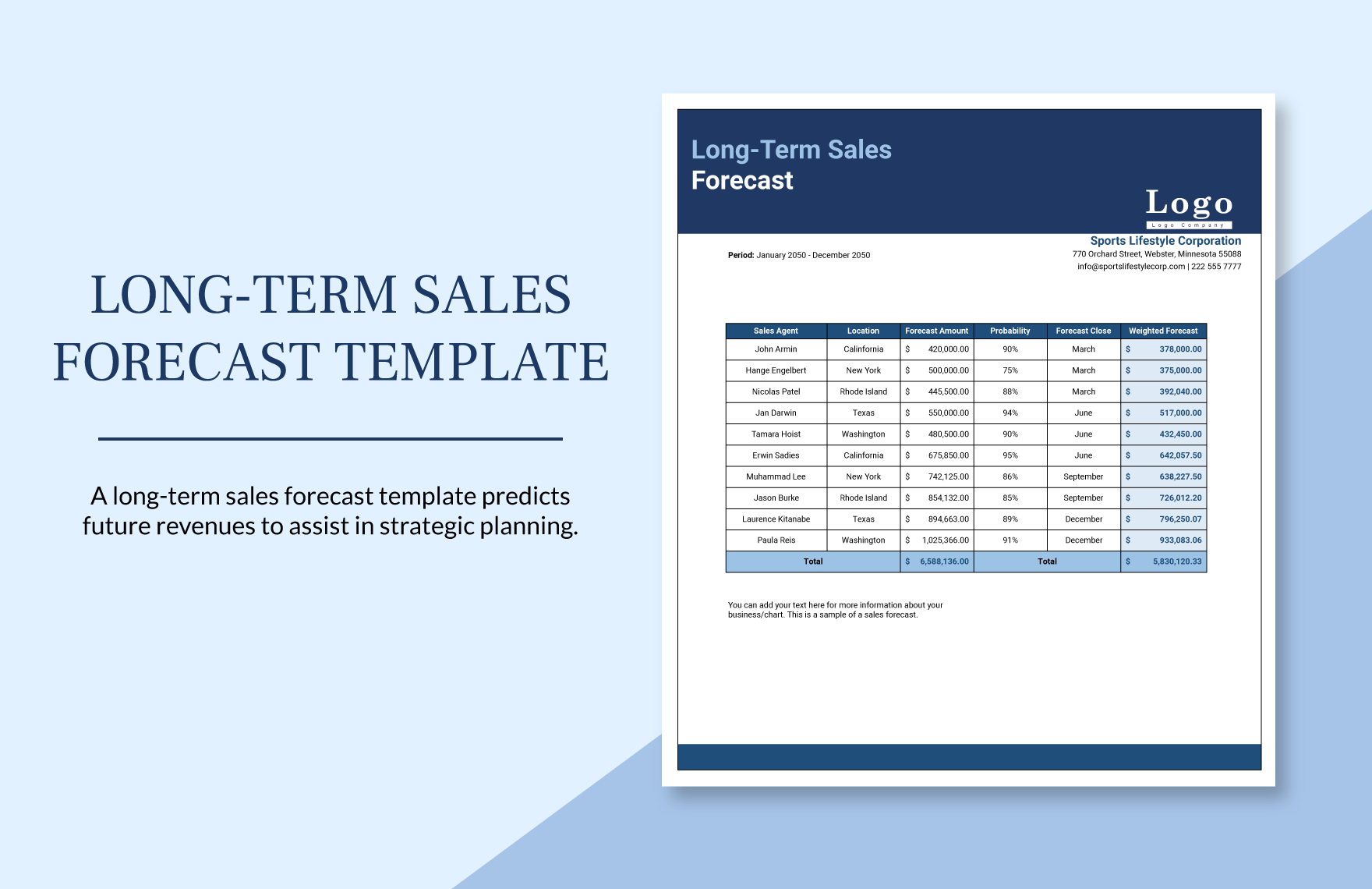

Long-term Sales Forecast Template

Sales Forecast Template

Business Plan Financial Template

Financial Business Plan Template

Digital Marketing Agency Marketing Plan Template

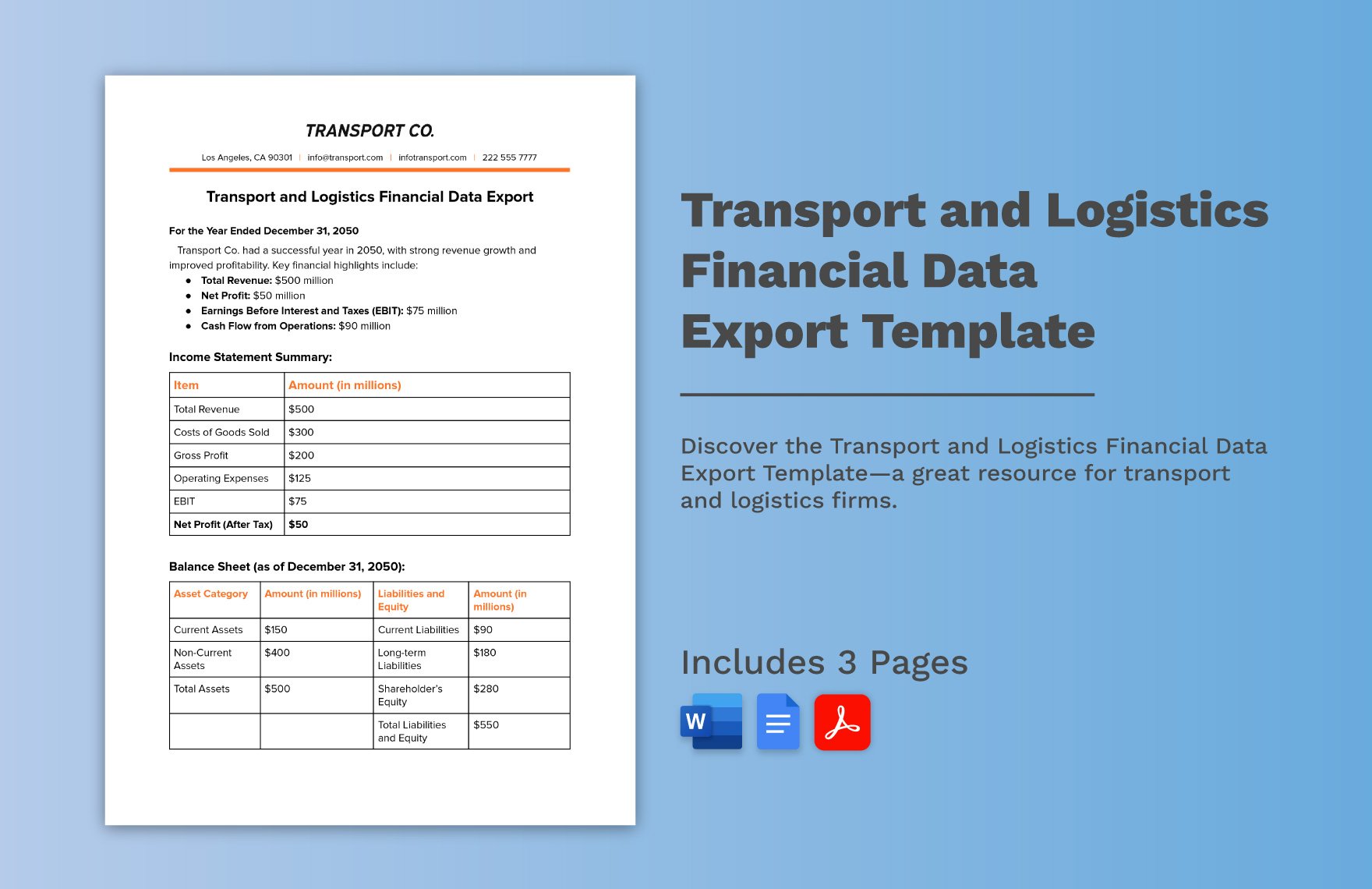

Transport and Logistics Financial Data Export Template

Transport and Logistics Financial Forecast and Projection Template

Yearly Compensation Financial Analysis HR Template

Financial Plan Template In Business Plan

In-depth Business Planning Toolkit

Financial Statement Tracking Template

Excavation Business Plan Template

Short Business Plan

Company Business Plan

Financial Services Marketing Plan Template

Business Financial Contingency Plan Template

Accountable Expense Plan Template

Blank Accountable Plan Template

There’s tons of money involved when it comes to running a business or establishing one. From the costs to the projected profit and loss statement, every business component is expressed in numbers to form a financial business plan. Gathering information and financial statements can take time, and organizing them in the report can be challenging.

Never miss out on necessary sections and descriptions of your financial plan with a ready-made sample. When you browse through Template.net’s plans, you can find editable professionally written financial goals for your every business — be it a small business or a startup company.

Running a food business? It would not be enough if you got the menu ready for your opening day. With a financial plan, you can think of ways to market your restaurant business or a new cafe to reach your projected financial goals. If you’re a financial expert, you can also start planning your own startup business and identify the costs and expenses in a financial advisor business plan.

Save time writing with simple premade financial plans on Template.net. The sample financial plans are downloadable and editable in Microsoft Word and Google Docs. When you don’t have any text editing format, you can open Template.net’s online workspace to create your business financial plan online. With the library of text formatting tools and font styles, you can exude credibility and add a touch of modern flair to your output. Then, upload your logo and hit the ‘Send’ button to share your business financial report via email instantly.

Download unlimited business plan Templates!

Business Financial Plan

A business financial plan is a critical and crucial document for companies and different kinds of business establishments. Whether you are a small start-up or an established corporation, it is necessary for you to create a business financial plan as it can help you achieve your desired financial condition and other strategic objectives. The financial planning process will allow you to identify the key points of your financial needs as well as the ways on how you can let the organization realize its financial goals.

- How Will a Financial Plan Be Useful for Me?

- Import/Export Business Plan Examples

Financial Plan Template

- Google Docs

Size: A4, US

Example Business Financial Plan Template

Micro Finance Business Plan Example

Financial Advisor Business Plan Example

Financial Plan for Start-Up Business Template

We listed a number of business financial plan templates and examples that you can use as document guides and references if you want to start creating your business’s own financial plan document. The examples available in this post can make it easier and faster for you to develop the format and discussion flow of your business plans .

Financial Plan Template Example

Size: 353 KB

Financial Planning Template Guideline Example

Size: 300 KB

Financial Planning for Small Businesses

Size: 338 KB

Importance of a Well-Formulated Business Financial Plan

A financial adviser marketing plan can help you select the best financial adviser that you can work with so that you can better the financial standing of your business. However, having a professional help you is not enough to maintain the efficiency and effectiveness of your financial actions. One of the documents that you can use to sustain your financial processes is a business financial plan. This document can also help you a lot if you want to grow as a business in terms of your finances. A few of the reasons why it is important for you to have a well-formulated business financial plan include the following:

- Having a business financial plan at hand can help your organization determine and focus on your financial goals may they be short-term or long-term. Being able to identify your objectives and goals can help you to balance and look into all the elements and factors that can affect your financial growth as a business. You may also see annual plans .

- Creating a business financial plan can promote communication between different business departments. This can ensure the management that all the stakeholders who are involved in the implementation of the business financial plan are fully aware of their tasks and obligations. Through this, ownership of responsibilities can be established.

- Developing a business financial plan can help you better manage your corporate finances. Some companies are not that sure where to start when it comes to financial planning. Having a business financial plan can help you have an easier time when dealing with the factors and elements that are needed to be put together so you can come up with strategies and tactics aligned with your financial vision and ability to execute call to actions. You may also see event budget examples .

- Making a business financial plan can give your business an idea about the expertise and skills that you need to look for when executing your financial plan. However, you have to remember that working with experts should not start in the processes of implementation as you need professional opinion and guidance from the very beginning of your financial planning undertaking. You may also see advertising plans .

Financial Business Plan and Budget Example

Size: 477 KB

Financial Plan Format Example

Size: 506 KB

Steps in Making a Business Financial Plan

Bridging the gap between your current financial condition and your financial aspiration can be overwhelming and intimidating. This is why you need to be well-guided in the implementation of your action plans that involve your finances and how you use them for your business operations. Here are the steps that you can follow when developing a simple and basic business financial plan:

- Create a team of professionals that can help you make a business financial plan appropriately. It is important for you to work with people who can add value to the planning processes of your finances. List down all the deliverable that are needed for the financial planning of your business so you can identify the people who are fit for the job.

- Identify your corporate goals. The objectives of your business financial plan must be aligned with the things that you also would like to achieve as a business entity. Ensure that the vision of your business can be reflected in your business financial plan so that the successes of the document and its implementation can benefit the entire organization. You may also see company plan examples .

- Assess the current financial condition of your business. This can help you identify the financial processes and decisions that can either positively or negatively impact your business. This will allow you to retain the activities that work to your advantage and remove the processes that can only ruin the financial sustainability of the business. You may also see strategic plan examples .

- List down your strengths so you can resort to them whenever needed. More so, present all the weak spots of your financial condition so you can work on them. Knowing your strengths and weaknesses can help your business financial plan to discuss the opportunities that you can take and the threats that you need to look into and prepare for. You may also see network marketing business plan examples .

- Put together all the business financial plans that you would like to realize based on your goals and objectives. Focus on the concerns that you would like to address and the plan of actions that you want to execute for the betterment of the business. Create call to actions that can be achieved with the help of your workforce and other stakeholders. You may also see business plan executive summary examples .

- Develop an immediate plan that will allow you to know how you can budget or use your finances. You can create a short-term, medium-term, and long-term plan depending on the attainability level of your vision and the realistic implementation of your desired actions.

- Review the entire business financial plan and incorporate adjustments or any other changes when necessary. Develop and update the document as you progress in your business financial planning and action plan implementation so you can maintain its relevance. You may also see business plan outline examples .

Business Plan with Financial Updating and Forecasting Guide

Size: 96 KB

Comprehensive Financial Plan for Business

Do You Really Need a Business Financial Plan?

Have you ever asked yourself on why a business financial plan is still used nowadays in various industries even if businesses can resort to the usage of other documents and/or processes when evaluating their financial decisions? The underlying reason behind this is most likely the effectiveness of the document which can be observed in the improvement of a company’s financial condition. Listed below are some of the reasons why it is essential for you to come up with a business financial plan:

- A business financial plan can allow you to list down all the realistic and measurable call to actions that your business can follow. Developing a document that can make it easier for you to implement the things that are necessary for the achievement of your financial goals can positively impact your business and the way it functions as a corporate entity. You may also see importance of business plan examples .

- A business financial plan can make you become more aware of the current financial status of your business and the analysis of your current condition as a corporate entity in terms of your finances. Moreover, it can give you an idea on where your money is going and whether you are efficient enough when it comes to allocating, using, and saving your financial resources. Understanding the flow of money within your business can make it more efficient for you to think of ways on how you can maximize the amount that you spend for particular undertakings. You may also see bar business plan examples .

- A business financial plan showcases the direction that you can follow so you can take care of your financial future. It is crucial for you to have a document that can serve as your guide whenever you execute action steps involving the finances of your business. Mapping your financial plan can make your business operations become more sustainable which in turn can allow you to better your professional relationships with your stakeholders. You may also see market analysis business plan examples .

- A business financial plan can teach you what you should know about financial analysis for small business plans and even for bigger-scale business planning documents. With the presence of this document, you can make sure that there is a proper assessment of your financial actions, strategies, tactics, and plans. This can help you execute necessary adjustments so that you can potentially reach your goals and objectives as well as realize your financial vision for the organization.

Financial Planning and Business Management Discussion Example

Size: 78 KB

Business Planning and Financial Forecasting Start-Up

Size: 1,023 KB

Business Financial Planning Example

Tips in Making a Business Financial Plan

As a business document, a financial plan promotes awareness of your current corporate financial condition while ensuring that the gathered information can be used to improve the financial standing of the business. This document deals with the programs and activities that are needed for financial growth as well as the resources that the business needs to execute its action plans. A few of the tips that can help you make a highly functional business financial plan include the following:

- Establish a goal and a purpose. Your business financial plan should be guided by a vision so you can make sure that you will develop a relevant and measurable plan for your organization. It is important for you to be aware of what you would like to achieve so you can be focused with the things that you need to prioritize. You may also see hotel operational business plan examples .

- Just like when creating a financial consulting business plan , you need to give importance to the clarity of your discussion within a business financial plan. Create an understandable and organized document that contains an in-depth discussion of your financial condition, goals, and plans.

- Be aware of the factors that can affect the effective usage of your business financial plan as well as the elements that are needed to be present and at hand so that your business can achieve its organizational and financial objectives. You have to study the different areas of the business and the trends that are present in various financial reports so you can thoroughly identify how particular activities impact your profitability and financial sustainability. You may also see implementation plan examples .

- Properly set the timeline of your business financial plan. For your goals to be attainable, you need to ensure that the time frame that you will follow is feasible. Knowing the time duration for each plan of action as well as the dates where milestones must be achieved and/or results are expected to show up can help you assess the success of your business financial plan accordingly. You may also see risk plan examples .

- Remember that business financial planning is a continuous process. You have to ensure that you will not just look into the output that you would like to have. You need to work in all the phases or areas of your business’s financial planning processes so you can ensure that you can come up with a useful document. You may also see bookkeeping business plan examples .

- Identify the financial barriers and hindrances for growth that the business is currently facing. In this way, you can also list down different activities and programs that can help you be prepared when facing risks and threats. Knowing the things that stop your business from growing financially can also make it easier for you to implement counteractions in a timely manner. You may also see lawn care business plan examples .

If you do not know where to start when making a business financial plan, make sure to check out the examples that we have provided you with in this post. Browse through these examples and identify the ones that you can use as your content and formatting guides so you can develop a business financial plan with ease. You may also see network marketing business plan examples .

Text prompt

- Instructive

- Professional

Create a study plan for final exams in high school

Develop a project timeline for a middle school science fair.

IMAGES

COMMENTS

Jul 29, 2020 · Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download the template here: Business Plan Excel Template The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business.

Download our free business plan template for your established business as a Word doc. A business plan for an established business serves as a roadmap guiding the growth and continued success of your business throughout its next stages.

Jul 11, 2024 · Here is everything you need to include in your business plan’s financial plan, along with optional performance metrics, funding specifics, mistakes to avoid, and free templates. Key components of a financial plan in business plans. A sound financial plan for a business plan is made up of six key components that help you easily track and ...

Get It Done Right with Our Free Business Plan Financial Templates. You Can Outline the Budget of Your Business and Design the Layout for the Breakdown and Balance Sheets. When It Comes to Financials, Template.net is the Answer.

Apr 26, 2024 · We listed a number of business financial plan templates and examples that you can use as document guides and references if you want to start creating your business’s own financial plan document. The examples available in this post can make it easier and faster for you to develop the format and discussion flow of your business plans .