- Free Essays

- Citation Generator

Growth vs Inflation

You May Also Find These Documents Helpful

Supply and demand and stationary aggregate demand.

an increase in the price level lowers the interest rate and chokes off government spending.…

RBA HSC Economic Essay

Reserve Bank conducts monetary policy with the aim of achieving a sustained low inflation rate while encouraging economic growth…

Federal Reserve Paper

Economics is the study of optimization of limited resources, apart from this money is required to produce prosperity and production. The Federal Reserve System is governments controlled body that acts as government’s central bank and whose primary responsibility is to manage the government controlled monetary policies (Investopedia, 2010). The following paper will explain the reasons behind government regulations. In addition to that, the paper will also look into the various functions of Federal Reserves, and the effect of its policies on financial market and institutions, and the impact on interest rates.…

Inflation in the Uk

The inflation rate of a country may be influential on corporate level judgments on topics like investments and to the everyday consumer through their savings. If Inflation increases in an economy drastically, it will cause recessions, and debt relief.…

Evaluate the Possible Consequences of a Rising Rate of Inflation for the Performance of the Uk Economy.

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Inflation is measured by the Consumer Price Index (CPI) and the Retail Price Index (RPI). The difference between CPI and RPI is that CPI excludes housing costs whereas RPI doesn’t, and also RPI excludes people in the top 4 per cent of earners. Central banks attempt to stop severe inflation along with sever deflation in an attempt to keep the excessive growth of prices to a minimum. A rising rate of inflation can potentially have beneficial and negative effects on an economy.…

Monetary Policy - Australian Economics

Explain how cash rate is set by the forces of supply/demand, but the RBA can increase/decrease the supply of funds in the money market through DMO’s; thus targeting the cash rate.…

Interest rates

Generally, if inflation is seen to be increasing at a rate that is disproportionate to the health of the economy - or basically growing faster than it can sustain - then official rates may be raised to in order to reduce consumer spending and slow down the economy.…

Sweden Country Brief

Inflation has remained low and relatively stable in recent years; at April 2012, the CPI inflation rate was 1.3 per cent. Unemployment has also fallen gradually and stood at 7.1 per cent as of December 2011.…

Rarguram Rajan Has Failed India's Banking Case Study

It is clear that the middle class will have to wait for the new RBI Governor for cheaper bank loans. The crude oil rates have come from $112/barrel to around $50/barrel during Rajan's tenure. Yet, he is waiting for inflation to come down further. One might ask whether it is RBI Governor's 'long-term vision' or the lack of it.…

Rbi Key Rates

The key policy or 'signalling' rates include the bank rate, the repo rate, the reverse repo rate, the cash reserve ratio (CRR) and the statutory liquidity ratio (SLR). RBI increases its key policy rates when there is greater volume of money in the economy. In other words, when too much money is chasing the same or lesser quantity of goods and services. Conversely, when there is a liquidity crunch or recession, RBI would lower its key policy rates to inject more money into the economic system.…

Us Financial Crisis and It's Impact on Indian Private Household Savings

Interest Rates in India had to be controlled by RBI because of the crisis, the tightening policy of RBI helped slowdown the interest rates so that the manufacturing sector is not affected and continues to grow at a considerable rate, which in turn affects the disposable income of…

Meeting Customer Expectations through 7M’s

The global growth slowed down from 3.83% in 2011 to 3.28% 2012. The same is the scenario in Advanced economies (1.59% to 1.29% in same period) and 7.76% to 6.67% in Developing Asia. The slowdown has been observed in all regions.…

4 Measuring The Cost Of Living

The goal of the CPI is to measure changes in the cost of living. It…

1 Personal Financial Is A Process

1) if government increase money supply at monetary market, the market interest rate will increase , which will affect your financial planning.…

Effects of inflation

This rise in relative inflation leads to a fall in the world share of UK exports and a rise in import penetration. Ultimately, this will lead to a fall in the rate of economic growth and the level of employment.…

Related Topics

- Monetary policy

- Interest rate

Conflict between economic growth and inflation

Readers Question: What is the relationship between inflation & economic growth?

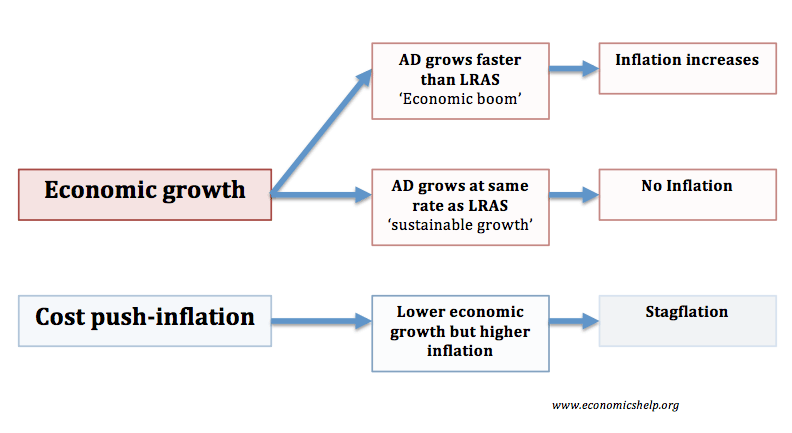

- If economic growth is caused by aggregate demand (AD) increasing faster than productive capacity (LRAS) – if economic growth is above the ‘ long-run trend rate ‘ then economic growth is likely to cause inflation.

- If economic growth is caused by increased productivity (LRAS), then the growth can be sustainable and not cause inflation.

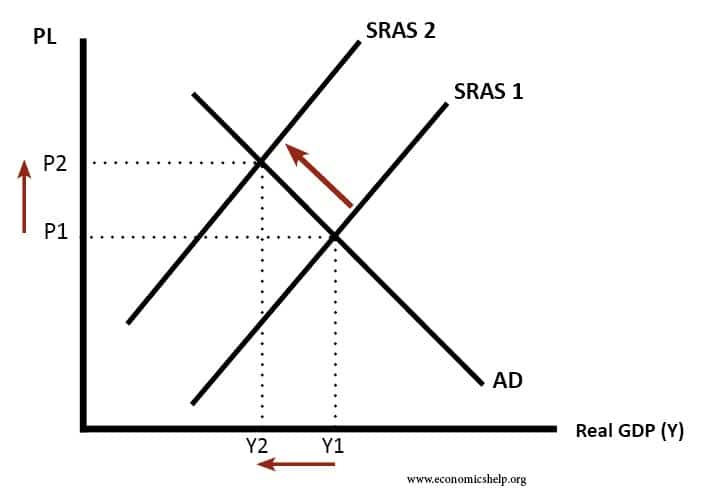

- With cost-push inflation, it is possible to get both negative economic growth and inflation at the same time ( Stagflation ).

Why can economic growth lead to inflation?

- If demand rises faster than firms can increase supply, firms will respond to the excess demand and supply constraints by putting up prices.

- In a period of rapid growth, firms will employ more workers and unemployment will fall. As unemployment falls, firms may find it harder to fill job vacancies; this shortage of labour will cause wages to rise.

- If wages rise, firms costs increase and therefore firms pass these cost increases on to consumers.

- Also, with rising wages, workers have more disposable income to spend – causing a further rise in aggregate demand (AD)

- With higher economic growth, people may start to expect inflation – and this expectation of rising prices can become self-fulfilling.

- Therefore, rapid economic growth tends to cause upward pressure on prices and wages – leading to a higher inflation rate.

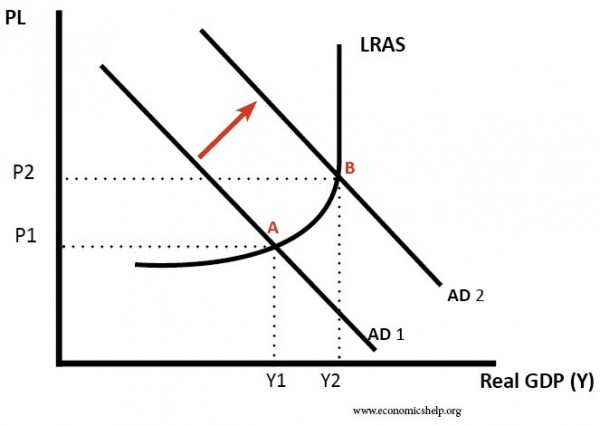

Diagram of Demand Pull Inflation

- Basically, If economic growth is above the long run trend rate (average sustainable rate of growth over a period of time) then inflation is likely to occur.

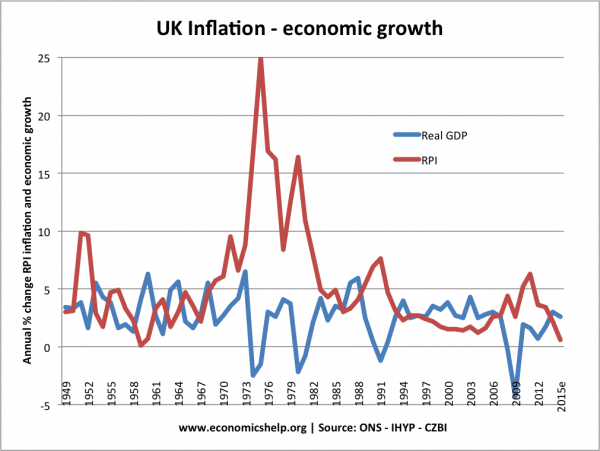

Lawson Boom – late 1980s

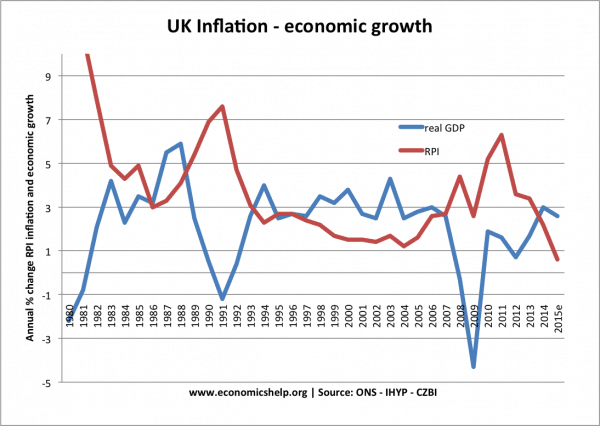

An example of high growth causing inflation was the Lawson boom of the 1980s . In this period, economic growth reached an annualised rate of up to 5%. This was much higher than the UK’s long-run trend rate of growth (of around 2.5%) and this rapid growth caused inflation to increase to 11% for some months.

High economic growth in the late 1980s – led to high inflation. The recession of 1991, brought inflation down.

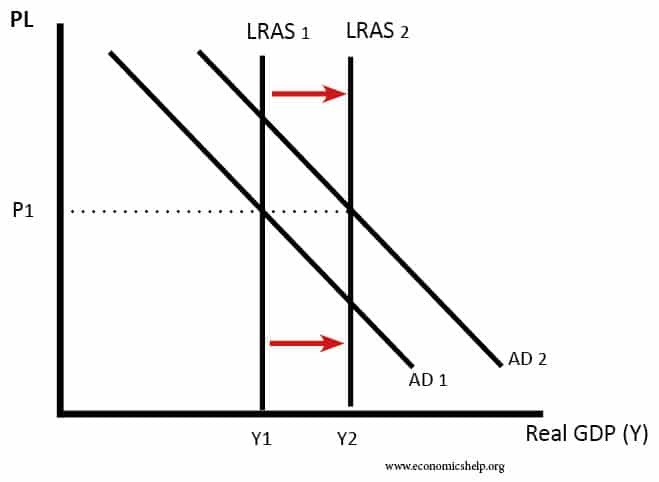

Economic growth and low inflation

It is possible that we can have economic growth without causing inflation. If growth is caused by increased productivity and investment, then the productive capacity of the economy can increase at the same rate as aggregate demand (AD). This enables economic growth without inflation. For example, between 1993 and 2007, the UK experienced low inflationary growth. This is partly due to economic growth being sustainable i.e. close to the 2.5% average; it was also due to productivity improvements such as privatisation and more flexible labour markets.

Diagram showing low inflationary growth

Increase in both LRAS and AD enables growth without inflation.

Low inflation causes long-term economic growth

It is also argued that low inflation can contribute to a higher rate of economic growth in the long term. This is because low inflation helps promote stability, confidence, security and therefore encourages investment. This investment helps promote long-term economic growth. If an economy has periods of high and volatile inflation rates, then rates of economic growth tend to be lower.

The cost-push inflation of 1973 (rising oil prices) led to recession because the higher prices lead to declining disposable income.

High Inflation and Low Growth

It is possible that an economy can experience low growth and high inflation (e.g. in 2009, 2011, 2017)

This can occur if there is cost-push inflation. Cost-push inflation could be caused by rising oil prices. It increases costs for firms and reduces disposable income. Therefore, there is lower growth, whilst high inflation. This is sometimes known as stagflation .

In 2011, the UK is experienced a fall in the rate of economic growth and relatively high inflation.

The inflation was caused by

- Rising food prices/oil prices

- Devaluation of the pound – causing rising import prices.

- Rising taxes

Therefore, despite low growth, inflation was high.

There can be a conflict between economic growth and inflation. In periods of rapid economic growth, inflation is likely to rise. However, it is possible to have both low inflation and positive economic growth – so long as the growth is sustainable and productive capacity increases at a similar rate to AD.

- Phillips Curve

- Economic growth v inflation

- Is unemployment a price worth paying for lower inflation?

- Inflation and unemployment in the UK

3 thoughts on “Conflict between economic growth and inflation”

- Pingback: Economic Growth vs Inflation: Which is more Important? — Economics Blog

what are conflictin relationships between inflation and employment

- Pingback: Growth v Inflation | Economics Blog

Comments are closed.

Inflation And Economic Growth Essay

The relationship between inflation and economic growth has been one of the most important issue since the beginning. By inflation, we mean a gradual increase in the level of price of goods and services over a period of time. When inflation increases, purchasing power of money decreases, cost of living also the cost of borrowing increases. All these causes the economic growth to decrease. However, if cost of borrowing decreases, this means investors will take more loans which will lead to higher investment, which also means labors will have more wages, (higher disposable income) and this in turn will increase consumption hence GDP will increase which will lead to economic growth. On the other hand, higher consumption means people will demand more which will lead to an increase in the price of goods and services. Therefore, the question is can lower inflation and higher economic growth coexist? This paper will talk about the relation between inflation and economic growth and whether these two factors are positively correlated or negatively correlated with each other. Global economy faced three types of inflation. The falling interest rates in the 1970s increased the aggregate demand which in turn increased the prices of goods. Prices were increased further after the oil price shock of 1973 which again boosted inflation and effected the industrial countries, more specifically developing countries. Mixture of monetary, trade and fiscal measure was used by the effected countries

Comparison Of The Us Economy Between 1940 And 1990

During this time Nixon was running for presidency and was running on a campaign that promised a return of more “conservative social and economic policies and a restoration of law and order”(Brinkley 741). He was voted into office, and by the year 1973 he had abolished the Office of Economic Opportunity. By the early 1970’s the United States was starting to see “long-term transformation of the American Economy”(Brinkley 745). During the 1970’s the United States was starting to experience extreme rises in inflations because of the end of cheap raw materials. During this time the cost of living rose by up to 15 percent (Brinkley).

Similarities Between Jimmy Carter And Ronald Reagan

Carter argued that Reagan's tax cuts and military increases would lead to inflation by increasing the Federal deficit. Carter's proposals focused too much on economic details and lacked the emotional appeal to galvanize the public. He was not able to communicate the real-life implications of the policies or explain how they would have a positive impact on people's lives and emphasized inflation as his focus in the administration's efforts to combat it. Furthermore, Reagan's suggestion was deemed unrealistic and potentially detrimental. To counter Carter's argument, Reagan had to consider another topic related to economic inflation, which was broader economics.

How Did Ronald Reagan Influence The Economy

Reagan continued the Nixon era price controls that choked the free-market. He deregulated banking and Congress passed and act to remove restrictions on savings and loan banks loan ratios. It is said that Reagan’s deregulation and budget cuts caused the 1989 savings and loan crisis. Reagan did not reduce government spending and increased defense spending to have “peace through strength”. Also, he expanded Medicare and increased the payroll tax to help Social Security stay

How Did Trudeau's Policies Affect Canada

As the Canadian economy began to slow down in the 1970s because of the oil crisis, the cost of living increased dramatically. Trudeau faced high inflation and unemployment rates. To help improve this situation, he introduced the Anti-Inflation Act in 1975 which limited increases in wages and prices. Instead of helping, this act made life more difficult for many Canadians. This policy rolled back wages or freezed wages for 4.2 million hardworking Canadians and on October 16th, 1976, over a million of these Canadians went on strike, bringing Canada to a standstill.

How Does The Federal Reserve Affect The Economy

Inflation can be linked to several different reasons. Some main reasons for the cause of inflation are consumer confidence, decease in supplies, and corporate deciding to charge more. (Investopedia) Consumer confidence is when consumers gain more confidence in spending due to a low unemployment rate and wages being stable. As the consumers continue to be more confident in spending this will cause for a high demand of product and services. As the manufacturers and the companies that are providing services see that the demands are going up, eventually they will drive up the prices for the products and services.

Richard Nixon And Watergate Scandal

This helped him get into office. To conclude, inflation worsened by the time Carter left office. The last president throughout this time was Ronald Reagan. He was in office from 1981-

The 1980 Presidential Campaign Between Ronald Reagan And President Jimmy Carter

In Carter's 1980 economic message, he stated the he would reduce the productivity and the gross national production. This would increase the unemployment rate which would handle the inflation, but would leave millions without a job. That went from 12 to 18 percent. Carter blamed the people for causing the inflation. Carter also blamed the Organization of the Petroleum Exporting Countries, Federal Reserve System, the lack of productivity.

What Are The Key Events Of The 1980's

After Reagan had been elected president, there was a promise that, “the rate of monetary creation would be slowed to help reduce inflation and interest rates” (Trescott, Page 161). When Reagan promised this, the citizens held him accountable to that and they trusted that he would be able to reduce the national debt and prevent any more money from being spent unnecessarily. This reveals the economy during the 1980’s due to the fact that Americans wanted the cheapest possible lifestyle and Reagan tried to accomplish that. In addition to promising this, Reagan had reduced the income tax from 70% to 28%.

Ronald Reagan Tough Economic Growth Essay

Ronald Reagan: An Era of Steady Economic Growth In a time when there was a lack of jobs, rising inflation, and an energy crisis all affecting the country, there was no doubt that Jimmy Carter, the sitting president at the time, would clearly be challenged by his opponent, Ronald Reagan. Reagan, a former governor of California, was known as a great communicator from his days being a governor. Reagan, who was best known at that time for the time he spent as a Hollywood actor and governor, came from humble roots, born and raised in a small apartment without running water and indoor plumbing. Later on, Reagan attended Eureka College in Illinois.

External Factors Of Chick-Fil-A

Just like any other organization, chick-fil-A is greatly affected by the external environment of the business. Often, the external environment is made up of all outside factors and influences that affect the way an organization conducts its daily operation. It is worth noting that an organization has no influence over its external factors and thus, it has to re-engineer and redefine its process, products and services to work under the influence of the external environment. Below are some of the external factors that affect Chick-fil-A. Consumer income Consumer income is in the wider field of economic factors that affect the sales level of the enterprise. Consumers with high income are likely to possess the power and the ability to purchase products from the company in large quantities.

Pestel Analysis Of Advertising

On the other hand, inflation rates have a negative effect on the growth of the advertising industry. Inflation rates affect the prices of goods and services which also affects the purchasing power. If the purchasing power of the consumers decline, manufacturing industries will experience low returns. They will shift the burden to the advertising industry by reducing investment in the industry and therefore affecting growth. The other economic factors also affect growth in one way or another (FME, 2013).

The Four Causes Of Inflation In Trinidad And Tobago

Inflation is the rate at which the general level of prices for goods and services is rising, and, then purchasing power falling over a period of time. When price level rises, dollar buys fewer goods and services. Therefore, inflation results in loss of value of money.

Literature Review Of Inflation

CHAPTER 2 LITERATURE REVIEW INFLATION (InvestorWords, 2015) stated that inflation is the increase in the general price level of goods and services in economy, normally caused by excess supply of money. Inflation usually measured by the Consumer Price Index (CPI). When the cost of producing goods and services goes up, the purchasing power of dollar will decrease. A customer will not be able to purchase the same goods and services as he/she previously could.

Roles Of Money In Macroeconomics Essay

ROLE OF MONEY IN MACROECONOMICS 1. Introduction Money can be seen as the medium of exchange which is acceptable while transaction is being undertaken between two parties. Some of the common forms of money are: - Commodity money: This is when the value of the good represents its value in terms of money like gold or silver. - Fiat money: This is when the value of the good is less than the value it represents - Bank money: It is the accounting credits that can be used by the depositor Money serves a variety of crucial functions in the economy and this is why it has gained an unparalleled influence in the matters of economy at micro as well as macro levels. Some of the features of money that make it so important for any economy are as follows:

Disadvantages Of Economic Growth

INTRODUCTION Economic growth is defined as the increased capacity of an economy to be able to produce goods and services in comparison from one period of time to another. This is figured by the genuine Gross Domestic Product (GDP) and development, and is measured by utilizing genuine terms such as “Balanced Inflation”. These terms help to remove any distorted views on the perceived outcome of inflation on the cost of merchandises produced. Likewise, Economic growth is related to the high expectations in a person’s standard of living. If the standards are high, it wouldn’t be beneficial for the economy as the working class individuals will face a lot of trouble.

More about Inflation And Economic Growth Essay

Related topics.

- Monetary policy

- Macroeconomics

- Unemployment

The Relationship Between Inflation and Economic Growth

In order to have a healthy economy, a country must have a certain level of economic growth. This is usually measured by the Gross Domestic Product (GDP), which is the total value of all goods and services produced in a country in a given year. In order to achieve economic growth, a country must first create more jobs. This can be done by businesses investing in new technologies or expanding their operations. As businesses invest more money, they hire more workers, which leads to more people having money to spend.

Individuals too have their role to play. Instead of holding or keeping money at home without spending it, they need to put it back into circulation. They may do this through savings, investing in various areas, for example investing in mutual funds , government bonds , money markets , ETFs and many more. The increased spending then leads to businesses making more money, which they reinvest into the economy, creating even more jobs and leading to even more spending. This process is known as the "virtuous circle of economic growth." However, there is one major factor that can disrupt this process; it is inflation.

What are the causes of inflation?

There are a number of factors that can contribute to inflation . One of the most common is an increase in money supply. When there is more money chasing after goods and services, prices will naturally start to rise. This is often caused by the government printing more money or by the central bank lowering interest rates and increasing the supply of money. Other factors that can contribute to inflation include an increase in taxes, a decrease in productivity, or an increase in the cost of raw materials. In some cases, inflation can also be caused by things like wars or natural disasters.

The role of inflation in creating economic boom and bursts

Inflation is the rate at which the prices of goods and services in an economy rise. It is measured as the percentage change in a price index, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). Inflation can have both positive and negative effects on an economy. On one hand, it can lead to economic growth by stimulating demand and encouraging businesses to invest. On the other hand, it can cause economic problems such as high unemployment and low productivity. Inflation is often caused by an increase in money supply. When there is more money chasing after fewer goods, prices will go up. Inflation can also be caused by an increase in costs of production, such as raw materials or wages. Governments use monetary policies to control inflation. They can do this by changing interest rates or by printing more money. Fiscal policy, such as increasing taxes or reducing government spending, can also be used to control inflation.

How inflation impacts a nation's currency

Inflation is a general increase in prices and fall in the purchasing value of money. The relationship between inflation and currency is inverse, i.e., when domestic inflation rate increases, the currency depreciates and vice versa. Inflation has a significant impact on a nation's currency. When inflation rates are high, it leads to lower demand for the currency, as people tend to invest their money in assets that will appreciate in value faster than the currency itself. This results in a depreciation of the currency. On the other hand, if inflation rates are low, people will be more likely to hold onto their cash, leading to an appreciation of the currency. In order to keep its value stable, a central bank may intervene in the foreign exchange market to buy or sell its currency. By buying its own currency, the central bank can increase the demand of the currency and prop up its value. Similarly, by selling its currency, the central bank can reduce the demand and cause the value to fall.

What are the long-term effects of inflation on a nation?

Inflation is defined as a sustained increase in the general price level of goods and services in an economy over a period of time. When the inflation rate is high, each unit of currency buys fewer goods and services. As a result, inflation erodes the purchasing power of money – a phenomenon also known as “dollar devaluation”. Inflation has both positive and negative effects on an economy. On one hand, it encourages spending and stimulates economic growth. On the other hand, it can lead to higher interest rates, which can discourage investment and slow down economic growth. Inflation can also create uncertainty and reduce the purchasing power of consumers. In addition to its effects on the economy, inflation has an impact on people's everyday lives. For example, when the prices of goods and services rise, people's standard of living decreases. Inflation can also lead to financial instability and cause problems for people on fixed income, such as pensioners.

Commercial Property Flipping: a Real Estate Trend to Explore

Crypto Glossary of Terms and Acronyms

Inflation And Economic Growth Essay

Show More Introduction: Most economists have been concerned about the relationship between inflation and the economic growth, for a very long period of time. The combination of the two, that is inflation and economic growth, they distinguish the variables of macro-economic. Inflation has a negative impact on the growth of the country; the South African statistics has proven that. I will be discussing that in details. Firstly, Inflation is simply defined as a situation where prices are perpetually and remarkably increasing in general. My definition of inflation is the situation whereby the economy reaches a contraction phase according to a business cycle. When an economy is in a contraction phase, prices start to emerge and the households, consumers they …show more content… The figures of population growth shall be expressed on a per capita basis. Consistently economic growth is simply measured in terms of real GDP. The effect of inflation in the economic growth in South Africa is a serious issue. Inflation in South Africa makes the growth of the a country to rise slowly, when the growth of a country rise slowly that surely makes the country to be considered as poor or under-developed country, compared to those developed countries that their economic growth are on a quick …show more content… The experience of the 1950s and 1960s had led economists to explain substantial inflation as a symptom of too high a level of total demand for output. The relationship between Economic growth and Inflation: Quarterly Economic growth rate % Inflation rate % 2011 December 4.2 7.1 2011 September 2.4 6.7 2011 June 2.3 6 2011 March 5.6 5.1 2010 December 5.5 4.5 2010 September 4.1 4.2 2010 June 3.8 4.5 2010 March 5 6.1 2009 December 4.5 7.4 2009 September 2.8 7.2 2009 June -3.8 7.5 2009 March 5 6.1 2008 December -2.7 9.8 2008 September 2.8 14.1 2008 June 5.5 13.2 2008 March 3.9

Related Documents

The dinner party economics by eveline adomait and richard marant: an analysis.

If this situation continues over the long term, it can result in hyperinflation (Dinner Party, Page 62). Hyperinflation is a condition where the price of goods dramatically increases over a short period of time. In Dinner Party (Page 42), it is discussed that an important issue in the economy is how we handle inflation over time. This is caused by the population spending to avoid pending expected price increases and creates a cycle that is hard to control. Hyper Inflation occurred in Germany in the 1920s as a result of a government program that issued debt (bonds) to raise money to pay for the results of World War I.…

Hyperinflation Analysis

Source A is written by George Grosz, a left-wing German artist, recalling his experience shopping during the hyperinflation crisis of 1923. It is of value to historian studying hyperinflation as it comes from Grosz himself, it is a first hand experience of a man whom was present the course of the hyperinflation and is therefore in an accurate position to write about the events that took place. He would have also experienced it first hand considering his occupation, this makes the content very valuable as it highlights the struggles and concerns faced by many normal working german citizens. The tone of the source is quite formal and direct, despite Grosz being a left-wing supporter which could limit the value of this source, he does not mention…

Dinner Party Economics Summary

Issues with the measurement of major economic concepts- By Deep Mukherjee In the first few chapters of the book Dinner Party Economics by Richard Maranta and Eveline Adomait, there were many new topics that are measured for data and decision-making. However, there are some issues regarding the measurement of the CPI and Inflation, the GDP and economic welfare, and the money supply that I would like to highlight. Firstly, there are a couple issues regarding the measurement of the consumer price index (CPI) which in turn is used to measure inflation.…

Inflation In America Case Study

If you bought a house for $150,000 with an annual inflation rate of 4 percent, it would take about 18 years for the house’s worth to double based on the Rule of 72. b. If you bought a Picasso painting at last week 's auction for $200,000 and the annual inflation rate is 10 percent, how long would it take to double your money? If you bought a painting by Picasso for $200,000 with an annual inflation rate of 10 percent, it would take around 7 years for the painting’s worth to double. c.…

Stock Market Collapse To Blame For The Great Depression

To what extent was the collapse of the stock market in 1929 responsible for the Great Depression? Topic – Causes of the great depression Focus – How much was the great crash to blame for the depression that followed Limitation – Great crash, depression, and other factors within that given time period Instruction – Give a balanced account and finalise to what extent the stock market collapse was to blame Traps – Don’t write about causes of the crash, do mention other causes PLAN Hayek: natural cycle of the economy = boom bust Normal healthy economic growth – output goes up leading to real (genuine) prosperity - depends on capital accumulation – investment - K/L rises . Investment depends on saving.…

Dotcom Bubble Vs Railway Mania

TERM PAPER: DOT.COM BUBBLE vs RAILWAY MANIA INTRODUCTION Our world has suffered numerous economic crisis ever since we had a concept of money. One may argue that economic crisis and economic growth go hand-in-hand. A very frequent source of economic crisis are speculative bubbles which essentially tailspin our economy into a euphoric state. They fill our investors with irrational exuberance, and coax them to go on an expensive investing spree.…

Federal Reserve Two Primary Goals

Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and moderate long-term interest rates and enhancing the Committee's ability to promote maximum employment in the face of significant economic disturbances. It has been determined that inflation…

Compare And Contrast Republicans And Democrats

Hence causing recurrent fluctuations in employment that regulates through time. Also causing a lower level of inflation would induce employers to make a bigger investment and employ more workers restoring the economy. Thus leading to the Multiplier Effect where the government spending leads to market activity including more spending boosting aggregate output. Therefore generating more income making citizens richer and causing citizens to consume more. By increasing aggregate output and generating income it provokes…

War In European History: Annotated Bibliography Of References

New York. Llewellyn H. Rockwell, L. (2008). War and Inflation. Mises Institute.…

The Great Recession Essay

In 2007, the ongoing once-in-a-century financial crisis has seriously impacted the development of the United States, causing the subsequent Great Recession. What was the major factor that causes this recession? The financial crisis, triggered by American subprime mortgage crisis in August 2007, has gradually turned into a great recession. The central area of crisis is unquestionably Wall Street. Investment banks in Wall Street collapsed along with the recession Therefore, the subprime mortgage crisis, also known as “mortgage meltdown” is the immediate cause of the recession.…

Minimum Wage Must Be Raised

Inflation rates probably were not thought about at the time because the economy was doing well and there were no beginning intentions to raise the wage again. In…

Raising Minimum Wage

Is It Time to Give America a Raise? “ If raising the minimum wage to $15 per hour will raise the standard of living for the working poor, why stop there? Why not raise the standard of living for middle class as well by increasing minimum wage to $25 an hour? If we raised it to $100 an hour, we could have the best standard of living in the country! ”…

Sources Of Economic Growth

Analyze the main sources of economic growth in the Australian economy and the policies the Australian government can use to achieve a higher sustainable rate of economic growth. Economic growth is considered to be an increase in the volume of goods and services that an economy produces over a period of time. It is calculated through the change in real GDP over a certain time period. The main sources of economic growth are the changes in aggregate demand and supply, which encompass various factors, which influence the levels of economic growth in both short and long term periods. The Australian government also applies a range of policies in order to sustain a high level of economic growth in order to allow national wealth to increase and to…

Basic Characteristics Of The Great Depression

Though after the Great Depression the Inflation rate fluctuated but the fluctuation did not bring drastic change in the rate of Inflation as it did in the Great Depression…

Watson Leisure Time Sporting Goods Case Study

The company manufactures golf clubs, baseball bats, basketball goals, and other similar items. Mr. Watson is quick to point out the increase in sales over the last three years as indicated in the income statement, Exhibit 1. The annual growth rate is 20 percent. A balance sheet for a similar time period is shown in Exhibit 2, and selected industry ratios are presented in Exhibit 3. Note the industry growth rate in sales is only approximately 10 percent per year.…

Related Topics

- Monetary policy

- Unemployment

- Macroeconomics

- United States

Ready To Get Started?

- Create Flashcards

- Mobile apps

- Cookie Settings

studpaper.com

Home / Samples / Economics / Essay Example: Impact of Inflation on the Economy

Essay Example: Impact of Inflation on the Economy

Impact of Inflation on the Economy

Inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. It is a critical economic phenomenon that can have profound effects on various aspects of a country’s economic performance. Understanding the impact of inflation on the economy is crucial for policymakers, businesses, and individuals alike. This essay explores the multifaceted consequences of inflation on different sectors and facets of an economy.

I. Introduction to Inflation

1. Definition and Measurement

Inflation is typically measured using price indices, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). These indices reflect the average change in prices of a basket of goods and services over time. Inflation can be categorized into different types, including demand-pull inflation, cost-push inflation, and built-in inflation.

II. Effects of Inflation on Consumers

1. Purchasing Power Erosion

One of the primary effects of inflation on consumers is the erosion of purchasing power. As prices rise, each unit of currency buys fewer goods and services, leading to a decline in the standard of living for individuals on fixed incomes.

2. Uncertainty and Planning Challenges

Inflation introduces uncertainty into the economy, making it challenging for consumers to plan for the future. Long-term financial planning becomes more difficult as the value of money fluctuates, impacting savings and investment decisions.

III. Impact on Businesses

1. Increased Costs

Businesses often face increased costs during inflationary periods. The prices of raw materials, labor, and other inputs rise, squeezing profit margins unless they can pass these cost increases onto consumers.

2. Uncertain Investment Environment

Inflation can create an uncertain investment environment for businesses. Uncertainty about future prices makes it difficult to plan for capital expenditures and can lead to a delay in investment decisions.

IV. Effects on Employment

1. Wage-Price Spiral

Inflation can trigger a wage-price spiral, where workers demand higher wages to cope with rising prices, leading to increased production costs for businesses. This cycle can contribute to higher unemployment as businesses may be hesitant to hire new employees amid rising labor costs.

2. Impact on Real Wages

Real wages, adjusted for inflation, can either increase or decrease depending on how well nominal wages keep pace with rising prices. Inflation that outpaces wage growth can lead to a decline in real wages, affecting workers’ standard of living.

V. Monetary Policy Responses to Inflation

1. Role of Central Banks

Central banks play a crucial role in managing inflation through monetary policy. Tools such as interest rate adjustments and open market operations are used to influence the money supply and, consequently, inflation rates.

2. Inflation Targeting

Many central banks employ inflation targeting as a policy framework, setting a specific inflation target to guide their actions. This approach aims to balance the potential negative effects of inflation with the need for economic growth.

VI. Impact on Savers and Investors

1. Erosion of Savings

Inflation can erode the real value of savings over time. Individuals saving for retirement or other long-term goals may find that the purchasing power of their savings diminishes as prices rise.

2. Asset Price Effects

Inflation can also impact asset prices. While some assets, like real estate and commodities, may act as hedges against inflation, financial assets such as bonds may see declines in real value as interest rates rise in response to inflation.

VII. Global Implications of Inflation

1. Exchange Rates and Trade

Inflation can influence exchange rates, affecting a country’s trade balance. High inflation may lead to a depreciation of the national currency, making exports more competitive but potentially increasing the cost of imported goods.

2. Spillover Effects

In a globalized economy, inflation in one country can have spillover effects on others. Changes in commodity prices, interest rates, and exchange rates driven by inflationary pressures can impact international trade and financial markets.

VIII. Inflation and Income Inequality

1. Unequal Impact on Different Income Groups

Inflation does not affect all income groups equally. Lower-income households may be more vulnerable to the rising cost of essential goods and services, exacerbating income inequality.

2. Policy Considerations for Addressing Inequality

Policymakers must consider the distributional impact of inflation when formulating economic policies. Social safety nets, progressive taxation, and targeted assistance programs can help mitigate the impact of inflation on vulnerable populations.

IX. Conclusion

In conclusion, the impact of inflation on the economy is far-reaching and complex. It affects consumers, businesses, employment, and various other aspects of economic life. Policymakers must carefully navigate the challenges posed by inflation, using appropriate monetary and fiscal policies to maintain price stability while promoting sustainable economic growth. As individuals and businesses adapt to the changing economic landscape, a nuanced understanding of inflation’s effects is crucial for making informed decisions in both the short and long term.

Related Samples:

- Essay Example: The Principles of The CPI Calculation in Inflation Rate in Economics

- Title: Understanding the Dynamics of Inflation: Causes, Effects, and Mitigation Strategies

- Essay Example: The Concept of Inflation: Definition, Causes, Types and Fight Against It

- Essay Example: Thinking About Whether Inflation Could Be Good for the Economy

- Essay Example: Microeconomics and Its Main Functions

- Essay Example: Difference Between Communism vs. Capitalism

Looking for this or a Similar Assignment? Click below to Place your Order

Request for Studpaper Writing Service Today!

With a team of over 1500 homework writing experts, we are prepared and eager to assist you in enhancing your writing skills

Who We Are Contact Us FAQs

Privacy Policy Cookie Policy Refund Policy Revision Policy Terms and conditions Fair user disclaimer

Blog Pricing Samples Expert

Using this writing service is legal and is not prohibited by any university/college policies. MD: Looking for technical writing help? Get professional technical writing help from our academic experts

The papers we provide at Studpaper should serve as model and reference papers for our clients. These research papers should solely be used for reference purposes.

Copyright © 2024 Studpaper. All rights reserved.

IMAGES

COMMENTS

The present growth rate of our country has dropped to nearly three and a half year low of 5.5%. India’s GDP growth for the 1st quarter of the current FY 2012-13 stood at 5.5% compared to 5.3% in the last quarter of the previous financial year. Also it is much lower compared to 8% GDP growth in the same quarter last financial year.

Nov 15, 2017 · The recession of 1991, brought inflation down. Economic growth and low inflation. It is possible that we can have economic growth without causing inflation. If growth is caused by increased productivity and investment, then the productive capacity of the economy can increase at the same rate as aggregate demand (AD).

Haslag (1997) pointed that Tobin effect shows a permanent effect of inflation on growth but once steady state level is achieved then there is no growth. Hence, the effect of inflation on growth is temporarily and in transition from one steady state capital level to another steady state capital level (00, 1997, p.13).

The relationship between inflation and economic growth has been one of the most important issue since the beginning. By inflation, we mean a gradual increase in the level of price of goods and services over a period of time. When inflation increases, purchasing power of money decreases, cost of living also the cost of borrowing increases.

Nov 9, 2021 · The role of inflation in creating economic boom and bursts. Inflation is the rate at which the prices of goods and services in an economy rise. It is measured as the percentage change in a price index, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). Inflation can have both positive and negative effects on an economy.

Let us see these arguments as follows. For example, Teshome(2011), from descriptive analysis, both inflation and economic growth are increased from 2004 to 2010, then, the author conclude that both inflation and economic growth related positively ,ie, between 2004 to 2010 inflation facilitated economic growth through high spending on consumption.

The experience of the 1950s and 1960s had led economists to explain substantial inflation as a symptom of too high a level of total demand for output. The relationship between Economic growth and Inflation: Quarterly Economic growth rate % Inflation rate % 2011 December 4.2 7.1

Sep 1, 2022 · This growth of demand pushes costs somewhat higher as providers attempt to make a greater amount of what buyers and organizations need to purchase. When inflation becomes excessively low, or vice versa, a horrendous cycle can wreak havoc upon our economy. High inflation has a wide scope of negative ramifications for economies.

Impact of Inflation on the Economy Inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. It is a critical economic phenomenon that can have profound effects on various aspects of a country’s economic performance. Understanding the impact of inflation on the economy […]

It is in this context, it will be interesting to know the inflation-growth nexus in developing countries. The objective of this study is to examine the inflation-growth nexus in India using annual data for the period 1972–2007. We will examine the relationship between growth and inflation in India.