- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/INV_StockBrokerageFirms_GettyImages-1367390496-ec42699e206e4c8cab856297cdfe2099.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What Is the Importance & Purpose of a Business Plan?

Small-business owners have been known to describe business plans in the most colorful terms. Since a business plan requires a huge time commitment, it's understandable why you may have heard it described as "detailed," "expansive" and even "exhausting." Business plans can be all of these things, but there probably isn't a small-business owner alive who wouldn't add another word to the list once the exercise is complete: "Necessary."

The main purpose of a business plan is to answer two key questions. What does this business hope to accomplish? How are we going to accomplish it?

Advertisement

Article continues below this ad

Start from the Bottom Up

This is no lead-in to a pep talk, but if it serves as one, it would be OK with the U.S. Small Business Administration. It has long touted a business plan as the foundation of a business – and you know what would happen to a house if it were built on a shaky, unreliable foundation.

Small-business advocates like to say that a business plan is a must-have document for both potential business partners and investors. But after contemplating the purpose, importance and actual contents of a business plan, you might agree that it's most valuable to the small-business owner who writes it.

More For You

What is an appendix in a business plan, how to write a constitution for a nonprofit organization, how to make a paragraph in an email, how to create a positive work culture, components of project scope statements, grasp the purpose of the plan.

Writers would say that they are guided by purpose; they have to know why they are writing and what they hope to achieve. Although it may ultimately consist of dozens of pages, a business plan must answer two fundamental questions:

- What do I hope to accomplish?* How am I going to accomplish it?

These questions serve as a backdrop as the business plan probes:

- The business model of a new venture

- The opportunities and risks it faces

- Current market trends, including customer demand, competition, business volume and prices

- The business' objectives

- Financial projections

All told, the business plan functions as a "road map for how to structure, run and grow" a business, the SBA says.

Grasp the Importance of the Plan

Anytime you assign your thoughts to paper, you hopefully achieve clarity of purpose; good writing demands it. For the small-business owner who is understandably a bit "fuzzy" on some of the details of launching a business and all that it involves, a business plan can crystallize concepts and ideas.

In this way, a business plan becomes a compass, supplying direction and focus as an entrepreneur's business vision takes shape.

Many small-business owners liken the launch of their business as a journey. It's an apt analogy – and one worth extending. If you wouldn't embark on a trip across town, much less across the country, without figuring out how you're going to get there, it defies logic how anybody could consider embarking on the journey of a lifetime without a business plan. It should take the front-row seat before the journey even begins.

The Plan Should be Written Without Delay

That distinction is important for two other reasons, besides navigational value:

- Many researchers, including those at Harvard Business Review, find that the most successful entrepreneurs don't procrastinate writing their business plan. They get to work on it between six and 12 months after deciding to start a business.

- Once you make the commitment to launch a business, you will have time for little else. It will become the focus of your time and energies.

Open the Table of Contents

Like that demanding college professor with high expectations, reviewing a template of a business plan has a way of dispelling any notion that a business plan can be written in one night, or even two. It takes time to do it right and complete the sections in a thoughtful manner. The sections include:

- The executive summary

- Company description

- Product or service offering

- Management and organization

- Market analysis

- Marketing and sales management

As you go about implementing the countless details involved in starting a business, you probably will refer to your business plan repeatedly. It may become your most valuable resource, so don't even think about filing it away – unless you file it under "N," for "necessary."

- U.S. Small Business Administration: Write your business plan

- SCORE: What is the purpose of a business plan?

- Business Case Analysis: Business Plan Purpose, Contents

- Harvard Business Review: When Should Entrepreneurs Write Their Business Plans?

Mary Wroblewski earned a master's degree with high honors in communications and has worked as a reporter and editor in two Chicago newsrooms. She worked alongside a noted Chicago area nutritionist and holistic healthcare adviser whose groundbreaking work focuses on the “whole” patient rather than focusing on one ailment or problem to the exclusion of everything else. Mary writes extensively about healthy eating and healthy living topics.

This website uses cookies to enhance the user experience.

Like this content? Sign up to receive more!

Subscribe for tips and guidance to help you grow a better, smarter business.

We care about your privacy. See our Privacy Policy .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast

You can do this! Tour LivePlan to see how simple business planning can be.

Have an expert write your plan, build your forecast, and so much more.

Integrations

For Small Businesses

For Advisors & Mentors

What Is a Business Plan? Definition and Planning Essentials Explained

11 min. read

Updated November 22, 2024

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster , and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential.

The biggest mistake you can make is not writing a business plan, and the second is never updating it. By regularly reviewing your plan, you can understand what parts of your strategy are working and those that are not.

That just scratches the surface of why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those who are ready to start a business. It’s just as valuable for those who have an idea and want to determine whether it’s actually possible. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

Market and competitive research alone can tell you a lot about your idea.

- • Is the marketplace too crowded?

- • Is the solution you have in mind not really needed?

Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability, and you can paint a pretty clear picture of your business’s potential.

Document your strategy and goals

Understanding where you’re going and how you’re going to get there is vital for those starting or managing a business. Writing your plan helps you do that. It ensures that you consider all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll know where you want your business to go and how you’ve performed in the past. This alone prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors.

So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can keep it up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but also easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover:

- • The problem you’re solving

- • A description of your product or service

- • Your target market

- • Organizational structure

- • A financial summary

- • Necessary funding requirements.

This will be the first part of your plan, but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table.

Lastly, outline the steps or milestones you’ll need to hit to launch your business successfully. If you’ve already achieved some initial milestones, like taking pre-orders or early funding, be sure to include them here to further prove your business’s validity.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the industry’s overall state and potential, who your ideal customers are, the positioning of your competition, and how you intend to position your own business.

This helps you better explore the market’s long-term trends, what challenges to expect, and how you will need to introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps.

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add them.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history.

Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing your business’s viability. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- • Sales and revenue projections

- • Profit and loss statement

- • Cash flow statement

- • Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first; only add documentation that you think will benefit anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function depend on how you intend to use your business plan . So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan (sometimes called a detailed business plan ) is a formal document meant for external purposes. It is typically required when applying for a business loan or pitching to investors.

It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

A traditional business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update and much easier for you, your team, and anyone else to visualize your business operations.

The business model canvas is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan . Sometimes referred to as a lean plan, this format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan.

A one-page business plan is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Growth plan

Now, the option that we here at LivePlan recommend is a growth plan . However, growth planning is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes .

However, it’s even easier to convert into a more detailed business plan thanks to how heavily it’s tied to your financials. The overall goal of growth planning isn’t to just produce documents that you use once and shelve. Instead, the growth planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, concise, more focused on financial performance, and ensures that your plan is always up-to-date.

How can you write your own business plan?

Now that you know the definition of a business plan, it’s time to write your own.

Get started by downloading our free business plan template or try a business plan builder like LivePlan for a fully guided experience and an AI-powered Assistant to help you write, generate ideas, and analyze your business performance.

No matter which option you choose, writing a business plan will set you up for success. You can use it to test an idea, figure out how you’ll start, and pursue funding. And if you review and revise your plan regularly, it can turn into your best business management tool.

Like this post? Share with a friend!

Kody currently works as the Inbound and Content Marketing Specialist at Palo Alto Software and runs editorial for both LivePlan and Bplans, working with various freelance specialists and in-house writers. A graduate of the University of Oregon, he specializes in SEO research, content writing, and branding.

Table of Contents

Related articles.

Noah Parsons

November 23, 2024

What Is Accounts Receivable (AR)? [Definition + 6 Ways to Improve]

Cash Flow Explained | What is it, Why it Matters, and How to Calculate

November 22, 2024

Paid Vs. Free Business Plan Software — Which is Right For You?

Cash Flow Vs. Profit | What’s More Important for Your Business?

- Business Planning

Defining Business Plans: Purpose, Components, and Types

Written by Bizplanr Team

Published Jun. 17 2024 · 10 Min Read

Do you know that about 1 out of 4 small businesses fail within their first year of operation?

It's tough to survive out there. However, having a solid business plan can be really helpful in setting stages for long-term success.

It not only separates successful ventures from the rest but helps map out where you want to go with a series of business ideas, how you'll get there, and how much money you'll require.

But the question is—what is a business plan and how does it help?

In this blog post, we'll answer such questions and describe all the basics of business plans, along with their key components and various types.

Sounds good? Let's dive right in!

What is a business plan?

A business plan is more than just a written copy; it's a living document that describes your business idea, objectives, strategies, and financial projections.

Whether you're a startup seeking funding or a well-established business looking to stay on track, a comprehensive business plan is essential and beneficial for both. It guides your business's strategic decision-making and long-term growth.

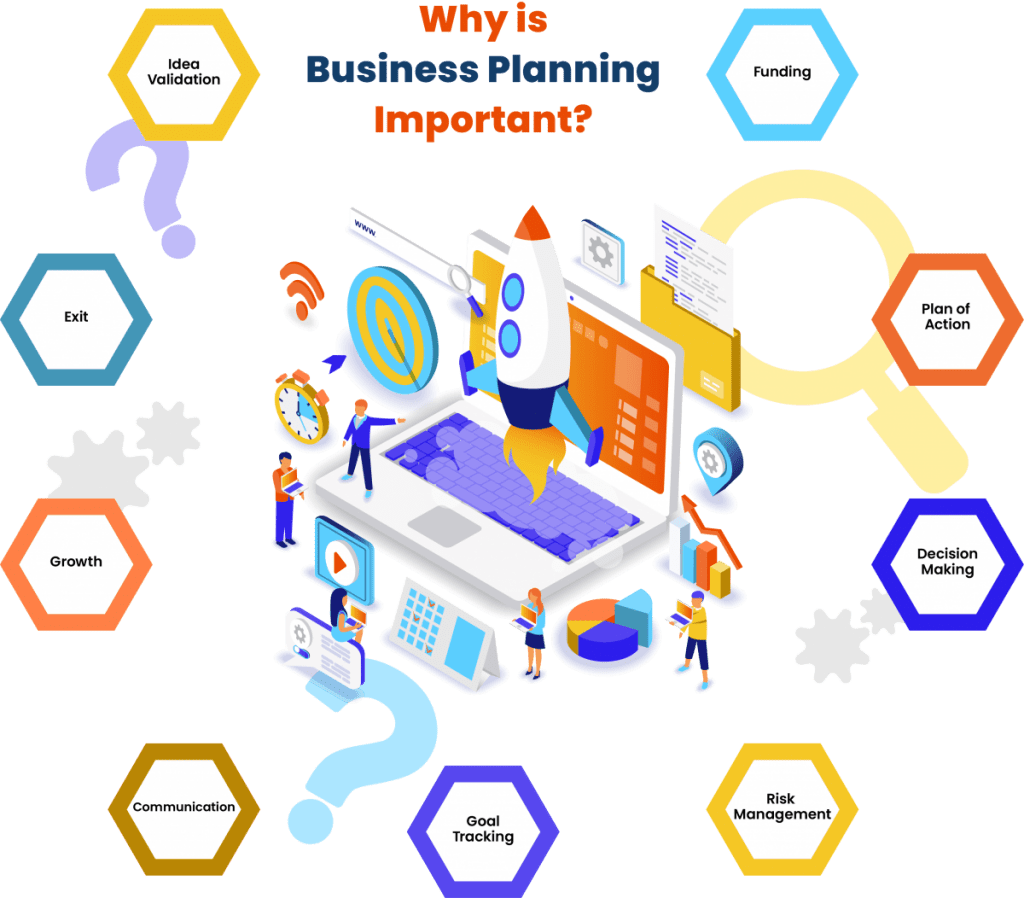

Purposes of a business plan

Well, having a business plan can serve as a strategic roadmap for entrepreneurs and small businesses. It guides them at every step of business planning.

Here are a few reasons why a business plan is necessary:

Showcase your business idea

A good business plan provides an opportunity to tell everyone about your business, including its concept, objectives, core values, and strategies.

It allows you to clarify your big goals and priorities, figure out your strategic plan to achieve those goals and chart a clear path forward to success.

Secure funding

As an entrepreneur, you must understand how much money you will need to start and grow your business. At that time, having a solid business plan would make it easier to map out and ask for help from investors or lenders.

It gives valuable insights into the financial viability, scalability, and profitability of your business, presenting why your business is a smart investment.

Identify potential risks and challenges

With the help of an effective business plan, you can identify the potential risks and challenges before they arise and impact your business venture.

It allows you to anticipate the obstacles in the competitive marketplace and develop contingency plans. So, you can mitigate risks effectively and respond proactively to unexpected circumstances.

Measure your business performance

A business plan helps you set clear business goals and define key performance indicators(KPIs) to monitor your business's performance and progress against predetermined milestones.

This way, you can identify how well your business is doing, which strategies don't work well, and where you need improvements.

In simple terms, think of a business plan as a detailed blueprint that helps you move your business in the right direction.

Now, without further ado; let’s check out and understand what to include in a business plan.

What to include in your business plan?

As everyone knows, each business is different in its own way. Likewise, the details you include in a business plan can vary greatly depending on its specific needs and operations.

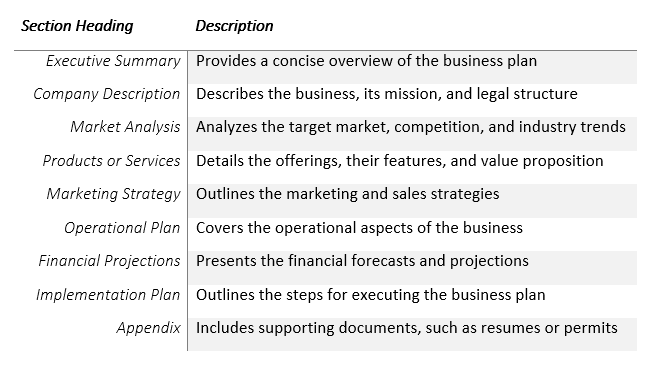

But several components are similar in most business plans:

Executive summary

An executive summary is the first and foremost section of a traditional business plan that provides a quick overview of the entire document.

It includes your business concept, goals, vision or mission statement, value proposition, marketing strategies, and financial highlights.

Since it might be the only section any reader will go through, you should keep this section brief yet informative.

Company description

The company overview section gives an in-depth understanding of your business. Here, you may add your business name, legal structure , vision statement, owners, company history, and other business-related facts.

Overall, it introduces your business to the readers and helps them know who you are and what your business is all about.

Market analysis

The market analysis section provides a thorough knowledge of the market landscape of your business. It includes industry size, expected growth potential, target market, potential customers, and recent trends.

Also, this section highlights the potential risks and market opportunities associated with your business.

Products & services

In the products and services section, you share details about the products or services you intend to offer, along with the features and benefits.

Also, it explains how your offerings satisfy customer needs and what makes them stand out from the competition.

Competitive analysis

The competitive analysis part is a detailed overview of your top competitors, including their strengths & weaknesses, products or service offerings, prices, and marketing & sales efforts.

This section also highlights the competitive advantages of your business and explains how different and superior you are compared to others.

Well, conducting a SWOT analysis could be an effective way to draft this section.

Sales and marketing strategy

The sales and marketing plan involves a brief description of the strategies you’ve decided to market or promote your business.

It includes your unique value proposition , online and offline marketing strategies, local advertising, and external promotional campaigns.

This will allow investors or partners to understand how you attract customers, build brand loyalty, and increase sales.

Operations plan

The operations plan of a business plan outlines how your business will run on a day-to-day basis, ensuring the smooth functioning of your business operations.

It comprises details like staffing needs, manufacturing or production processes, inventory supplies, quality measures, equipment or technology used, and company facilities.

Management Team

The management team section is all about the dedicated, qualified, and experienced executive team managing the primary business activities.

It introduces the key members of your team, along with their educational qualifications & backgrounds, industry experience, and skills to drive your business forward.

Financial projections

A financial plan summarizes the monetary information that will give potential investors a quick peek into the financial health of your business.

You may consider including profit and loss statements, balance sheets, revenue, sales projections, cash flow estimates, funding needs, and exit strategies in the financial plans.

In the appendix , you can add supporting documents that you think can convince investors and don’t fit into specific sections of your business plans.

These documents include all the research papers, resumes of key team members, financial projections, product or company images, award certifications, legal agreements, etc.

After knowing all these elements, you've now got a better understanding of how to write a comprehensive business plan that can guide your entrepreneurial journey and help impress investors or lenders.

When to consider writing a business plan?

Confused about when to start writing your business plan? You are not alone; it's a common yet important question for many entrepreneurs.

But not to worry; we've got the scoop on when it's just right to start the business planning process and consider drafting a plan.

Here are some situations you may consider:

- When you've got a business idea

- Before getting funds from investors or lenders

- At the time of launching a new business

- During expanding or scaling your existing business

- While facing challenges or uncertainties

Similarly, even if you're not currently looking for funding or facing any challenges, it's always good to have a business plan in place for long-term strategic planning.

How long should a business plan be?

Now, let's figure out the length of a business plan—it's not just about the page counts. It's also necessary to maintain the level of detail or clarity in the plan to grab the readers’ attention.

There are some pointers that you should keep in mind while writing business plans:

- 15-minute readability: Your plan should not be a long read, instead it should be easy to scan for readers in about 15 minutes or less.

- Keep it concise: Not everyone is interested in reading a 100-page business plan. So, make it simple and concise by adding the most significant points in 25-30 pages.

- Know target audience needs: If you're writing to secure a business loan, you'll need more detailed and formal plans. While your internal team might prefer a shorter plan of 5-10 pages.

- Financial details: You will need less financial information for startup companies, while established companies require comprehensive financial plans.

In short, your plan’s length depends on a few factors, including the type & complexity, target audience, purpose, finances, and many more.

Types of business plans

Since there's no one-size-fits-all, business plans come in different shapes and sizes that are tailored to unique business needs and objectives.

Let's explore some common types of business plans available in the market today:

One-page business plan

A one-page business plan is a simplified version that outlines all the essential information on a single page. It includes things like the target market, product lines, milestones, and sales forecast.

Also, it's an excellent way of quick reference and pitching to potential investors or partners.

Startup business plan

A startup business plan is one of the most common types of business plans, specifically designed for new business ventures.

This type of plan highlights the main points of your business such as unique ideas, strategies, go-to-market plans, and financial projections.

Lean business plan

A lean business plan is a compact document that summarizes the most important aspects of your business. It focuses more on business strategies, tactics, key metrics for success, and finances.

This plan provides a streamlined approach for quick updates and adjustments as you go, emphasizing flexibility and adaptability.

Strategic business plan

As the name suggests, a strategic business plan focuses more on long-term planning and strategic growth. It outlines your business's vision, mission, objectives, 3-5 years of operations, and action plans.

Using strategic plans helps you achieve sustainable growth and anticipate upcoming business challenges.

Growth or expansion business plan

A growth business plan details the strategies to expand or scale up an existing business. It helps identify new market opportunities, launch new products or services, and aims to grow market share.

This growth plan is all about highlighting long-term goals and mapping a clear path for business growth.

What-if business plan

A less formal what-if plan comes in handy when your business is facing a tough decision or your business outcome turns unfavorable. It can help explore different scenarios and how they might affect your business.

This type entails contingency plans that will help you prepare for unforeseen events or changes.

From all the types mentioned above, you may select the one that best fits your business-specific needs and objectives.

Start preparing your business plan with Bizplanr

Now, you understand what a business plan is and why it matters the most. So, you'll need to put extra effort into your plans.

However, preparing a business plan from scratch isn't always easy. It requires the right tools, additional support, and resources to get started.

Well, Bizplanr—a modern AI business plan generator could be a great companion here!

It offers easy-to-follow guides and valuable resources that help you draft a simple plan in about 10 minutes. And this will make your planning process a breeze.

So, why wait? Try Bizplanr now!

Get Your Business Plan Ready In Minutes

Answer a few questions, and AI will generate a detailed business plan.

Generate your Plan

Frequently Asked Questions

What financial statements should be included?

Comprehensive plans typically include financial statements that provide a clear picture of your business's financial health, performance, and viability. For instance,

- Income statement (Profit & loss statement)

- Balance sheet

- Cash flow statement

- Revenue projections

- Expense forecasts

- Tax returns

How often should a business plan be updated?

You should update your business plans regularly, at least once a year or quarterly, to reflect changes in the company's strategy, operational aspects, and goals.

However, your plan may need more frequent updates when notable changes occur in the business environment, such as new product launches, emerging market opportunities, or challenging events.

What makes a good business plan?

A good business plan is one that is clear, concise, and comprehensive. It effectively outlines your business concept, goals, strategies, and its potential for success. However, you may consider using a business plan app to create a strong business plan.

What are the 3 C's in a business plan?

The 3 C’s of a business plan are:

- Concept : It highlights the core idea or vision of the business.

- Customers/clients : Analyzing and understanding the target customers is integral for a successful business.

- Cashflows : It focuses on managing finances for the financial viability and sustainability of the business.

Bizplanr is a renowned AI-powered business planning platform providing entrepreneurs and business owners with tools, templates, and resources for creating lender-ready business plans. Check out Bizplanr blog for more such interesting reads.

Follow Bizplanr Team

Related Posts

How Much Does a Business Plan Cost - Free vs Paid Options

Types of Business Plans You Need to Know

11 Common Business Plan Mistakes to Avoid in 2024

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

What is a Business Plan? Definition and Resources

9 min. read

Updated July 29, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template . These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

15 Min. Read

How to Write a Business Plan for an Outpatient Medical Practice

7 Min. Read

How to Write a Bakery Business Plan + Sample

3 Min. Read

11 Key Components of a Business Plan

5 Min. Read

Business Plan Vs Strategic Plan Vs Operational Plan—Differences Explained

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to use a Business Plan?

Business Plan Template

- Vinay Kevadia

- September 18, 2024

- 15 Min Read

If you’re entering the entrepreneurial world, you’ve likely been told to start with a business plan.

However, simply creating a business plan isn’t enough. The true powers of a business plan unravel when you use it actively to drive your business forward.

Whether you’re launching a business, securing funding, evaluating growth opportunities, or guiding your team— a business plan is more than just a document. It’s a versatile tool that can support almost every aspect of your business when used consistently.

Want to learn how?

Well, in this blog post, we’ll dive into more details about how to use a business plan . But before that.

Why is a business plan important?

A business plan is an important document, whether you use it for formal or internal use.

Here are a few reasons why this document is important:

- Gives you a roadmap to achieve your business goals.

- Offers a framework for making strategic decisions.

- Outlines the business goals and sets benchmarks for tracking business performance.

- Secures funding for your business by demonstrating financial sustainability.

- Helps overcome the challenges by developing mitigation strategies.

- Aligns the team members and stakeholders by facilitating clear communication.

Now, let’s understand the different use cases of a business plan to launch, grow, and fund your business.

How to use a business plan to start a business

A business plan is a quintessential document that can help you plan and launch your business. Whether you need to validate a business idea, establish your goals, or equip yourself with the understanding of a target market—a business plan helps with it all.

Here’s a more detailed overview of how a business plan can help start a business.

1. Validate your business idea

Before investing money in a business venture, you need to test the viability of your business idea.

You need answers to questions such as:

- Should I pursue this business venture?

- Who will be the target audience for my solution?

- How much sales will it make?

- What is the scope of scaling my business idea?

- How is my idea different from that of existing competitors?

A business plan can help you find answers to these critical questions.

Whether it’s the market, competitors, product offerings, expected sales, business objectives, or your finances—a business plan helps you assess each aspect of your business idea to test its overall feasibility.

Evaluating your business idea using a business plan forces you to address the gaps in your business idea.

This validation step ensures you don’t invest time and resources in an idea that may not succeed.

2. Establish business goals and mission

A business plan offers a strategic framework to transform vague business aspirations into concrete goals. It makes it easier for you to communicate what your business stands for and what it aims to achieve with a clearly defined mission statement.

A business plan helps you align the short-term goals of your business with its ultimate mission. It guides you in setting clear KPIs to help you track the progress and success of your goals.

With a well-defined mission, objectives, and value proposition, businesses tend to stay on their path.

3. Navigate market entry

Writing a business plan nudges you to understand the market space in which you will operate. It helps you determine your unique brand position and guides you to target the right set of people for your business.

A business plan details the exact steps of how you will introduce your business to the market. Whether it’s the position of your product, identifying your go-to-market strategy, strategizing the pricing, or securing the distribution channels—a business plan guides you to perfect your market launch.

To summarize, a business plan minimizes the risks associated with a new market by strategizing your market entry.

4. Plan the operations

A business plan turns your vision into an operational roadmap to help you optimize your business operations.

It helps you find answers to questions like these.

- What will be the SOP (standard operating procedure) of a business function, i.e., manufacturing, marketing, and hiring?

- Who would look after particular processes?

- How many people will you require to fulfill a task?

- Where will you perform the business activity?

- How will you ensure the quality of your services?

An operational plan outlines everything, helping you allocate the resources and establish clear workflows.

A business plan is further used to identify the gaps and bottlenecks in your operations. A regularly reviewed business plan accommodates the changing market conditions by introducing timely changes to your operations.

In short, an operational plan ensures that the business runs smoothly and is prepared to scale optimally.

5. Identify professional gaps

Even if you’re starting a business as a solopreneur, you will require the expertise of professionals to fulfill your business objectives. This is where a business plan can be of help.

Writing a business plan helps you identify the gaps in your current capacity. With this knowledge, you can determine the skills and people essential to execute your business strategy.

This can be an accountant, product developer, marketing specialist, legal head, or financial expert.

Once you identify a professional gap, a business plan can assist in onboarding the right type of people for your business. It offers you a detailed hiring and training plan to ensure everyone on the team remains aligned to a common goal.

6. Build strategic a. alliances

Entrepreneurs need to build relationships with suppliers, vendors, and other strategic partners early on to accelerate their market growth.

A business plan can help identify potential partners for your business. Besides, it can help you build valuable relationships with your potential partners by outlining the benefits and goals of the partnership for them.

When you approach someone for a partnership, they will have questions about growth, finances, business goals, and your outlook. Having a business plan handy will help you answer them confidently.

Moreover, a business plan will help evaluate the favorable terms of a strategic alliance. This knowledge can be used to guide the negotiations and get a contract that favors your business.

This excerpt by Jonathan Goldberg , the CEO of Kimberfire , demonstrates how they used a business plan to get a significant partner on board.

“ Kimberfire acquired a partnership with the World’s largest diamond manufacturer using a business plan. By clearly outlining our market strategy and growth projections we were able to demonstrate the value of a partnership that offered direct access to high-quality diamonds at competitive prices. This partnership not only bolstered our inventory but also allowed us to pass on significant savings to our customers, thereby enhancing our competitive edge.”

7. Forecast the capital requirement

Lastly, a business plan can help you understand capital requirements for your company. It helps determine the costs to start and run your business.

Such information guides you in evaluating your funding options.

By referring to your startup costs , you would know whether bootstrapping would be enough or if you would need loans and funding from investors.

These are just a few ways in which one can use a business plan to start a business. However, the use cases can be exhaustive depending on the details put into your plan.

How to use a business plan to secure funding

Most businesses may require funding from external sources to launch or grow their business.

Now, it doesn’t matter whether they secure funding through investors, banks, or grants. What’s important is that they have a business plan to prove the financial sustainability of their business.

Here’s how one can use a business plan to secure funding and convince investors:

8. Define funding needs

A business plan can help you determine the funding essential for your business. Moreover, it can also help evaluate the funding source that’s better suited for your business.

By building detailed projections for costs, expenses, sales, and cash flow, your plan helps determine the capital essential to launch or grow your business.

Additionally, a business plan can be used to justify your funding demands. A clear funding plan explains how you intend to use the investor’s money, i.e., buy new machinery, hire new staff, or expand the business operations.

This clarity demonstrates careful financial planning and builds investors’ confidence in your venture.

9. Manage fundings

Your funding plan already includes details about where you intend to use the money. However, you can now use it to create a detailed roadmap.

A well-planned business plan demonstrates how you should delegate the funding to different business departments. Additionally, it guides you in managing the secured funds efficiently by helping you set budgets, financial controls, and performance trackers.

This detailed approach assures investors that their funding is used responsibly and efficiently.

Further, as you update the plan, identify if your execution strategy requires change. If so, you can make the necessary changes and update the investors, keeping them in the loop. This will help them trust you more.

10. Support the loan application

A business plan is compulsory for everyone submitting an SBA loan application. Even private lending firms would require a business plan to make their funding decision.

A well-detailed business plan is sufficient to support your loan application. It demonstrates that you have conducted essential planning to make your business idea viable and sustainable.

A business plan answers all the questions that a lender might have to assess your creditworthiness and repayment capacity.

Questions such as:

- What will be the profitability of your business?

- What are the major cost drivers of your business?

- What will the debt-to-equity ratio be if you approach investors?

- How stable is your cash flow?

- What will the ROI and the payback period be?

Lenders can trust you more when they get essential answers backed with data.

That said, let’s understand how a business plan can drive enterprise growth.

How to use a business plan to grow your business

A business plan can be instrumental in testing different scenarios, evaluating growth opportunities, and making strategic decisions. All these help you grow your business and face the challenges efficiently.

Here’s how:

11. Guide strategic decisions

A business plan can help you make strategic decisions that align with your ultimate growth objectives.

Whether you want to launch a business at a new location, invest in new machinery, introduce a new product line, hire new employees, or onboard new technology—a business plan can help.

A business plan provides a framework to assess the risks, opportunities, and financial impact of a strategic decision on your business. It helps determine the right time to launch your growth initiative and demonstrates whether making a particular decision will be fruitful or not.

This way you won’t make a decision that can put you off your long-term goals.

12. Monitor business performance

Once you make a strategic decision, use your business plan to clarify the strategy and outline your execution plan.

A business plan can additionally assist in measuring business performance against set KPIs and performance benchmarks. Regularly evaluating these metrics allows you to identify areas that may need improvement or adjustments.

By using the business plan as a performance management tool, you can make data-driven adjustments to your approach and grow your business sustainability.

13. Adapt to market changes

A business plan isn’t set in stone. It’s a living document that adapts to changing market conditions.

It can be used to adapt your strategies based on new market data and shifts in customer preferences. Such regular updates help you remain competitive and agile in the face of changing market conditions.

Additionally, a business plan can help you develop a response to an emergency crisis.

A business plan accommodates all your strategies, milestones, metrics, tactics, and projections in one place. By using the plan as a performance dashboard, you can anticipate the changes and adjust the priorities to deal with the crisis.

Mark McShane offers a practical example of how he used a business plan to meet contingencies in his company, Cupid PR .

“When we hit cash flow problems, we followed the financial contingency section of our plan to manage expenses and short-term funding. We were able to quickly implement the cost-saving strategies and secure a bridge loan to stabilize our finances without sacrificing growth. Business plan made it possible to respond to this challenge efficiently which gave us a 40% revenue increase the next year.”

14. Test different scenarios

A business plan can be used as a tool for scenario analysis.

As the regulatory, economic, and competitive landscape of a business evolves, you need to test and plan for different scenarios, like:

- Entry of a new competitor

- Regulatory changes

- Technological advancement

- Market demand shifts

- Natural disaster

Businesses can evaluate the financial and operational impact of these scenarios using a business plan. By using business plan forecasts as a base, they can prepare for various worst- and best-case scenarios.

Preparing for different scenarios helps you leverage the opportunities and mitigate the risks whenever they arise.

Those are quite a few ways in which a business plan can assist or facilitate growth. Entrepreneurs can find more ways to use a business plan depending on the depth that their plan covers.

How to use a business plan internally

One of the most essential uses of business plans is to guide your operations, management, and team toward the goal.

Here’s how.

15. Align team and stakeholders

A business plan is an excellent tool for aligning your team and stakeholders toward a common mission.

A well-crafted business plan documents the company’s goals, mission, KPIs, and milestones. With the basics clearly articulated, it gets easier to bring your internal team and stakeholders on the same page.

Now, you don’t need a detailed plan to convey your goals. A simple list of goals and how they contribute to your ultimate objectives is enough for internal use.

This quote from our conversation with Shawn Plummer , the CEO at the Annuity Expert , shows how he used a business plan to drive a 50% revenue increase in 2 years:

“By breaking down our growth strategy into clear, measurable goals, the business plan became more than just a document; it was a tool for uniting our team. Everyone, from marketing to operations, understood how their efforts related to our overall goals. This connection was critical to our success, resulting in a 50% revenue rise in just two years.”

16. Streamline business operations

A business plan can streamline business operations by outlining the standard operating procedures (SOPs) for different business processes. It’s further used to define the responsibilities, resource allocation, and hiring plans for your organization.

Remember, a well-crafted operations plan acts as a guidebook for your business. It details every process, responsibility, and resource essential for running a smooth operation. Referring to it can help increase efficiency, reduce waste, and enhance productivity.

Now if you’re writing a traditional plan, you’ll have a detailed section on business operations. However, if you’re writing a lean plan, we recommend building a separate internal operations plan to guide your business operations.

Simply list the business processes, create an outline, and use ChatGPT to write a business plan . Your internal use operations plan doesn’t need to follow a specific format or structure. It should just distill clarity.

17. Efficient performance reviews

A business plan outlines the KPIs and goals, offering you a benchmark to evaluate the individual performance of team members. These metrics can be used to track actual results and take appropriate actions.

A business plan helps foster the environment for continuous development by linking performance to strategic goals.

That’s a few definite ways to use business plans for internal growth and management. Internal business plans can follow any structure or format, as long as they get the task done.

How to keep your business plan relevant

As we discussed, a business plan is a living document that requires frequent updates and changes to maintain relevancy.

Ideally, one should update their business plan at least once a year to keep it useful. However, businesses in highly volatile or competitive markets should consider reviewing it quarterly.

A business plan must represent accurate market conditions. If that’s not the case, a review should incorporate new market trends into the strategy, adjust the operational realities, and revise the financials. This ensures that your plan remains relevant and realistic to help you achieve your business objectives.

Include your team members in the review process to ensure the strategies address their key concerns and align with the entire organization.

All in all, adopt a flexible planning approach to keep your plan relevant to the dynamic world.

By now, you have a thorough understanding of the different uses of a business plan. However, these use cases are only relevant if you have a realistic and actionable business plan offering a true overview of your business. Only then can you use a business plan to launch, grow, and fund your business.

Now, draft a quick business plan using the Upmetrics business planning app . Its AI planning features, business plan templates, financial forecasting assistance, and detailed guides will help you prepare a reliable business plan in no time.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

What is the most common use of a business plan.

A business plan is most commonly used to secure investments from investors. Additionally, organizations use it to define strategic goals, guide business operations, and evaluate the company’s performance.

How do you use a business plan for a small business?

A business plan offers crucial help to small businesses in the following ways:

- Idea validation

- Navigating market entry

- Planning business operations

- Building strategic alliances

- Forecasting the capital requirements

How do I use a business plan to attract investors?

A business plan can be used to prove the financial sustainability of a business idea. Investors can evaluate whether their investment would offer enough ROI, profitability, and growth by referring to your in-depth business plan. When they see that you’re well-prepared to face real market situations, they feel convinced of your ability to run a business.

How often should a business plan be updated?

Ideally, you should update a business plan at least once a year. However, businesses operating in dynamic, competitive markets need more frequent reviews. This can be monthly or quarterly.

Why is it important to review a business plan over time?